10 per cent assessees contribute 90 per cent GST in Telangana

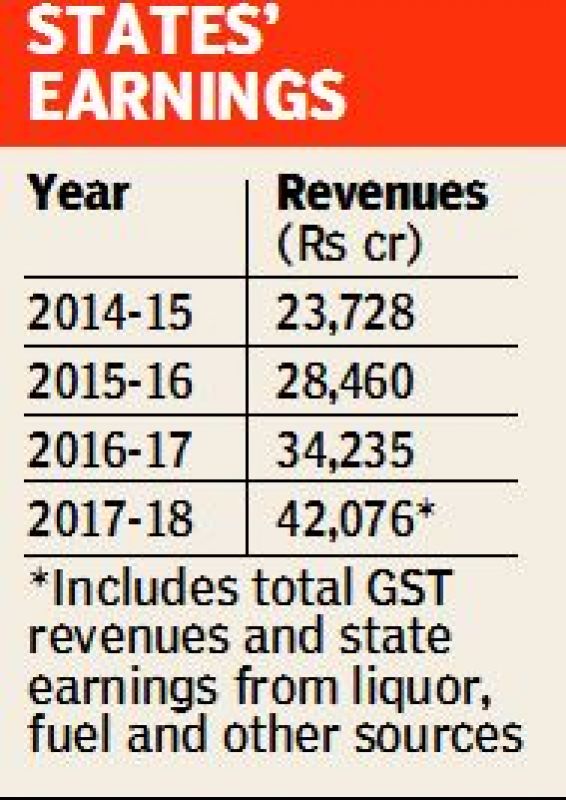

Hyderabad: In the first year of GST implementation ending July 1, Telangana state was able to achieve better tax revenues when compared with the pre-GST regime, and reduce the revenue gap considerably.

However, the country’s youngest state is below the national average in terms of tax compliance. In terms of notices served for non-compliance and tax evasion, only 27 per cent have responded to the tax authority.

Return compliance in Telangana state was 85 per cent during July 2017-May 2018 as against the national average of 87 per cent. Returns filed for May 2018 were 62 per cent of the total assessees, while the national average was 69 per cent.

The four GST commisionarates in the state are gearing up take action against those who did not respond to the notices for not filing returns or mismatch of data.

“Out of the total 3.5 lakh assessees in the state, 10 per cent contributed to 90 per cent of the total revenues. Coming to tax evasion and non-compliance, out of the total 45,000 notices served so far, only 12,000 assessees responded. We’ll take legal action against those who didn’t respond,” said an official at GST Bhavan here.

Telangana state government has constituted a state-level screening committee (SLSC) on anti-profiteering to receive complaints and to forward them same to standing committee (SC) after scrutiny.

Mr M. Srinivas, commissioner, Central Tax, GST, and member of SLSC, said: “Till date, two complaints alleging profiteering have been forwarded by the SLSC to the standing committee for action. GST, enforcement measures have been gradually put in place to check non-filing of returns and tax evasion,”

He said Hyderabad zone had booked 23 cases involving Rs 41.09 crore against tax evaders so far and Rs 22.35 crore was recovered including Rs 11.15 crore in cash and Rs 11.20 crore in credit.

“With the wealth of data available, consequent to introduction of e-way bill, tax leakage is likely to be further plugged,” Mr Srinivas said.

According to GST officials, prices of purified water, toothpaste, hair oil, soap, staplers, shampoos, hair dyes, X-ray films, wrist watches, fans, pumps, UPVC doors, windows, etc, came down.

“Initial technical glitches were resolved. The prices of several consumer goods eased due to reduction in the total incidence of tax as GST ensures no cascading effect on prices. Adoption of lesser GST rate as compared to total of Central Excise and VAT reduced the tax burden on consumers,” said another official from Medchal GST.

According to GST data, the revenue gap in Telangana state considerably narrowed to 2.4 per cent from 27.8 per cent in August 2017, while the national average eased to 17.9 per cent from 28.3 per cent during the same period. This gives a revenue surplus for Telangana state as the state recorded higher revenues than pre-GST regime.