KIMS hospital to take over Sunshine

Hospitals are the new acquisitions where the bigger players buyout the smaller or not-so-successful ones.

As competition heats up in the healthcare sector, mergers and acquisitions have become the order of the day, resulting in an inflow of private equity along with brand names. Among the key players in Hyderabad are IHH Healthcare, General Atlantic, Parkway Patani Group, TPG and InvAscent, who are all trying to increase their share in large hospital brands while acquiring smaller hospitals in districts as ancillary units.

The most recent buzz in the twin cities is of an impending merger between Sunshine Hospital and KIMS Hospital. Sources say that KIMS will hold a 70 per cent stake and only Dr Guruva Reddy of Sunshine Hospital will be retained. All other stake holders will allegedly be ‘bought out’.

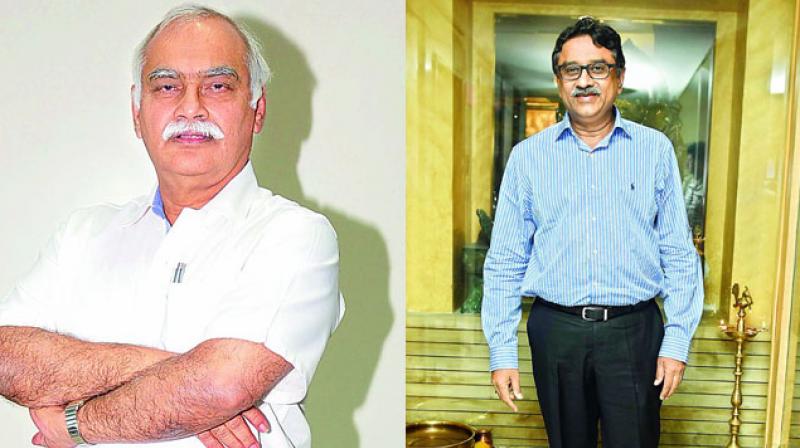

However, Dr Bhaskar Rao, managing director of KIMS Hospital (Secunderabad) explains, “Acquisition is a long process. It will take six to eight months. We are looking at Sunshine Hospital but it will depend on the private equity from investors in the market.”

Interestingly, while the acquisition process is largely based on the profit-and-loss statements, personal relations play a key role too, as in the case of the Sunshine-KIMS talks, where Dr Bhaskar Rao’s wife Rajyalakshmi and Dr Guruva Reddy’s wife Dr Bhavani are sisters. “Which is why Dr Gurva Reddy will remain to be part of the new venture too,” said a source in the know.

Acquisitions are also gaining momentum as managing a hospital is an expensive proposition, one where hidden costs can drain out the profits. A senior management employee of a private hospital explains, “The acquisition of Care Hospitals and Aster Prime Hospitals have emphasised the importance of having a good balance between manpower and technology to sustain the growing competition.

Hyderabad has a growing economy and there is adequate skill which will get a good leverage. These combinations put together, hospitals can command its price and who can afford it will opt for the hospital and care.”

Another development in the healthcare sector is Maxcure Hospitals, which was earlier a part of Sunshine Hospital. After the group split, Maxcure became an independent entity and acquired several smaller hospitals in the districts to improve its ‘outreach’. However, experts caution that the performance of the smaller hospitals must also be taken into consideration, lest the image of the bigger hospital is dented. However, Apollo Hospitals has been careful in its acquisitions as it bought the surgical centres unit of Nova Medical Centres Private Limited in 2015. The group, which is India’s biggest hospital chain with more than 10,000 beds across 70 hospitals in the country, has been expanding in niche markets, with the current focus in Uttar Pradesh. The boom in the hospital sector is also witnessing a consolidation of bigger private players where equity from overseas is bringing in technology while catering to the healthcare of non-resident Indians at comparatively lower prices.

Back-end offices now handle the overseas patients who can directly walk in for their appointments. This has not only done away with middlemen, but also reduced hopping from one hospital to another, along with improved post-operative and post-treatment follow-up. But acquisitions are not without their challenges. These facilities and equipment for instance, come at a price. A senior doctor explains, “The increasing facilities of pre and post-operative care have led to an increase in manpower, so prices have doubled. The standards set by one hospital are followed by another. The competition is adding to the price factor.” Young doctors from colleges are also looking at the bigger brands to get proper training, equipment and staff support.

As a result, smaller hospitals run by single doctors are falling short of the required healthcare professionals. Family physicians opine that the system must be divided into three types basic care for simple diseases; secondary care, where intervention is limited but with hospitalisation costs and tertiary care, and to deal with higher end interventions and complications.

They argue that most patients end up going to the big hospitals even for small complaints and pay more than required. If the system is streamlined, the basic and secondary care will help patients and smaller hospitals which have long been the backbone of the industry.