Budget, not such a sport!

The budget has the city's Gen-Y in deep debate about its pros and cons...

Fresh from the political oven, the annual budget is currently a rather toasty topic for lunchroom conversations — with the buzz around what exactly can the budget be perceived as: good, bad or ugly? Going by what’s out, the yays are the focus being on uplifting the rural strata of society and a significant increase in healthcare facilities. But the needs of the average urban consumer appears to have been put on the backburner. We document views of city folk from varied spectrums.

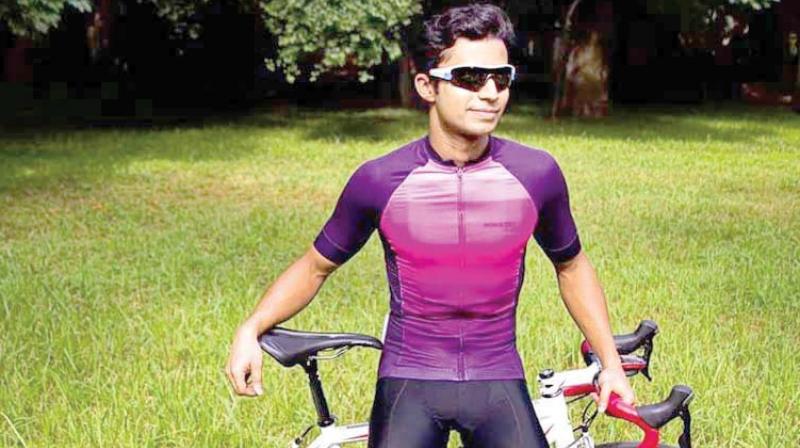

Break into a sweat, not! Sticking to your fitness resolve seems a tad harder – As fitness gear and workout equipment are likely to see a rise in pricing. “It’s getting worse. Instead of promoting sports by lowering import duty, they are hiking the tax,” states a rather infuriated cyclist and fitness enthusiast Phanibhusan Singhamahapatra, adding, “Cycling and running is a green path in today’s urban world, but the budget doesn’t reflect the government’s inclination to promote the things that help in reducing carbon footprint. The import duties are already 40 per cent on foreign cycling equipments, and it costs sometimes more than double the price in Europe or US. And now, basic workout essentials like running shoes and rackets will also see a price hike. That’s ridiculous as a lot of people will be discouraged to join sports when they see the prices of even the most basic items. It’s detrimental to national health and sports in general.”

Nothing very angelic about ‘tis: Entrepreneurs may not really be in complete support too. “The budget has taken rural concerns in consideration. But the biggest worry of start-ups ie angel tax has not been answered. This is important as otherwise start-ups will find it difficult to raise funds from angel investors,” shares city-based entrepreneur Rajeev Tamhankar, TBS Planet Comics. On the brighter side, Rajeev explains how thought has been given to senior citizens and he hopes the plan comes through. “No TDS for senior citizens on FDs comes as a good sign,” he adds.

Progressive, but disappointing: From prices of electronic gadgets, import duty on devices, cosmetic and skin care essentials and style accessories having shot up; ‘9-5-ers have enough to rant about. Nitin Hajela, an analyst at Ernst and Young asserts, “I was expecting a revision in income tax slabs this time, as salaried employees deserve something to look forward to and are the actual bread-winners and tax payers.” Voicing a similar disappointment is 24-year-old city lawyer Amith Amarnath who believes there hasn’t been a lot of thought given to uplifting the middle-class; “As a youngster in this country, I honestly expected more. It is really disheartening to see the middle class being ignored every time. It’s unfair as there isn’t really much in store for the middle class with respect to either restructuring of income tax slabs or any kind of boost, either to small scale industries, small scale businesses or start-ups. However, I’m happy about the allocation of huge funds and the importance given to the education sector. The transformation of black board to digital boards – that is a revolutionary step. And, another aspect that caught my eye is the health insurance scheme which has made health insurance affordable to all the classes of society.” Speaking from a student’s perspective, Garvita Gulhati, a B.tech student from PES University adds, “I really appreciate the idea of opening a medical school in every state because it will help create something like a chain of IITs, which is absent in the field of medicine. Special funding for students in IITs will help them in life and they absolutely deserve it for the hard work they’ve put in. It’s great that they are spending on college students as that is when you become independent, and the support of your government helps you progress.”