Tax scare in Tollywood

Filmmakers are now scared to reveal their films' earnings even if it's a big hit, because they fear income-tax raids.

Post demonetisation, income-tax officials have raided several T’wood filmmakers. So, in recent times where many filmmakers have claimed that their films are a super success and collected huge revenues, the producers of these movies didn’t breathe a word about it, because then they would have to pay a heavy tax for it.

Take the examples of Dhruva, Ekkadiki Pothav Chinnavada, Guatamiputra Satakarni, Khaidi No. 150, Shatamanam Bhavati or Nenu Local. All these films fared well at the box-office, but the producers didn’t speak about the exact collections. Most recently, income-tax officials raided the office of Gautamiputra Satakarni and the distributors too. It is reported that Gautamiputra Satakarni had huge profits even before its release. “That made the officials raid its offices to find out how much they paid in tax,” says a source.

Allu Aravind, who produced Dhruva that starred Ram Charan, says that the film stands as second highest grosser after Magadheera in Ram Charan’s career, but he didn’t divulge the details. Interestingly, he told the media that Khaidi No. 150 collected more than Rs 100 crore in just a week, and justified his announcement saying that he is a member of Chiru’s family. Meanwhile, Ram Charan, the actual producer of the film, didn’t utter a word about the revenues.

“Basically, when a producer makes a film, he enters into agreements, especially for remunerations and other business agreements. So the raids are to check whether the producer is making the right agreements with the proper TDS or not,” says Suresh Babu. He adds that if the officials have a doubt, it is their right to check whether the producer got his payments in a proper way or not.

“Producers don’t need to announce the budget or the profits of a film to the public. They are answerable only to the income tax officials and they pay once the film has completed its run,” says Thammareddy Bharadwaj. He adds that every producer pays the amount through the TDS.

But the problem arises when a big film releases. When the producers sell the film for high rates in different areas, they show only some amount as accounted for while the remaining becomes black money. The income tax officials want to check the excessive black money from these big films. “Maybe some of the producers are not paying the TDS and hence, the raids,” explains Thammareddy.

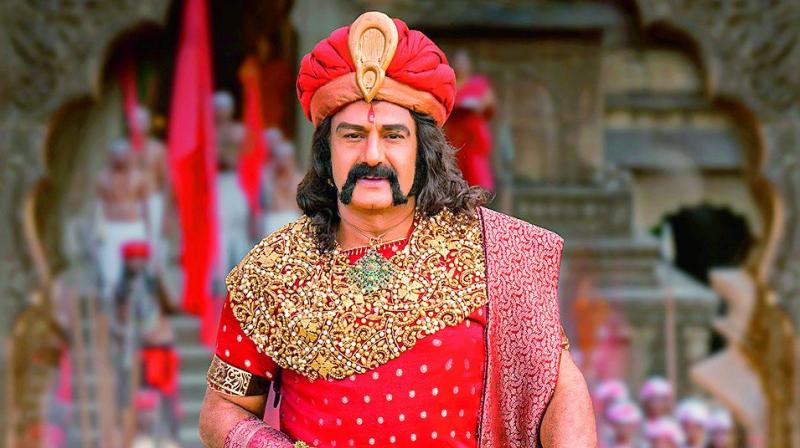

A still from Shatamanam Bhavati

A still from Shatamanam Bhavati

Though some films are huge hits, some exhibitors and distributors are also showing wrong collections when it comes to paying tax. “In some of the single screens, all the shows are housefull, but the exhibitor says that the show is only half full to avoid tax,” says a source.

“That’s the reason we are constantly requesting the government to pass a government order and make ticket booking online everywhere. More than half of the theatres are selling tickets manually. If you make it online, the government also gets entertainment tax on the ticket correctly,” say Suresh Babu and Thammareddy. Both say that though the film industry has appealed many times to the government, they are still waiting for the official order.

While filmmakers may not reveal exactly how much a film collects to the public, “everyone has the right to information and can find out how much a filmmaker pays as tax,” says Thammareddy. It is now up to the filmmakers to come clean about their payments and collections.