What we learnt about money in 2017-18

Personal finance is an ever-evolving space. So it pays to learn new lessons every year, if not every day.

The financial year is drawing to a close. This year, equity investors had a memorable run halted only by the announcement of a new tax on long term capital gains. There were plenty of lessons to be learnt in terms of money management. Let’s take a quick look at the lessons learnt.

CRYPTO BUBBLE

The biggest money trend in recent months was investment in cryptocurrency. Of all cryptocurrencies, Bitcoin’s rise and fall has been the most storied. Around a year ago, the Blockchain-based digital money was trading at around $1,000. By December, it had shot to nearly $20,000 fuelled only by speculation. Despite warnings from the government and the banking industry, many Indians bet on crypto. Sure enough, bubble burst. The government and industry action followed as well: the finance minister invalidated crypto as a legal tender, and banks have restricted the flow of money into crypto exchanges. Bitcoin is trading at around $9,000 today. The lesson: Don’t be willing to bet more on an investment than you are ready to lose.

POOR PERSISTENCE

Earlier this year, we learnt that Indians have a habit of buying and dumping life insurance policies. As per recent data, only two-thirds of life covers are renewed after one year, and one-third after five years. This is a worrying trend. Life plans are long-term instruments which should be bought after careful research of your family’s needs. Buying them repeatedly over the years means having to pay higher premiums. Dumping them prematurely means putting your family at financial risk.

HEDGE AGAINST MIDCAP RISKS

Mid-cap and small-cap mutual funds have a great run, earning sometimes as much as 40 per cent between 2017 and 2018. Greater investments flew into the category; however, it had run its course for now. As prices corrected sharply, returns from the segment declined. With market risks being higher in mid-caps, it would be wise to hedge your equity investments with large-cap investments, which are known to be less volatile over the long term.

IMPORTANCE OF CREDIT SCORE

Your credit score is becoming increasingly important. Today, the best loan and credit card offers are given to customers with the highest credit scores, which is a measure of their creditworthiness. The score is a numerical expression of your creditworthiness, typically a number between 300 and 900, with 900 being the perfect score. Today, any score above 750 is considered ideal. Don’t be in the dark about your score or wait till you apply for a loan to find out what your score is. You can find it out instantly. Just Google for “free credit score”.

SMALL SAVINGS PAID POORLY

Small savings schemes such as PPF and NSC have much to offer to the common man. But sharp corrections in the interest rate meant customers took home poor returns. The PPF today offers a paltry 7.60 per cent. The falling interest rate was one reason why Indians took to equity mutual funds in large numbers over the last three years. For the long-term investor, it would be wise to invest in a mix of small savings and mutual funds for best returns.

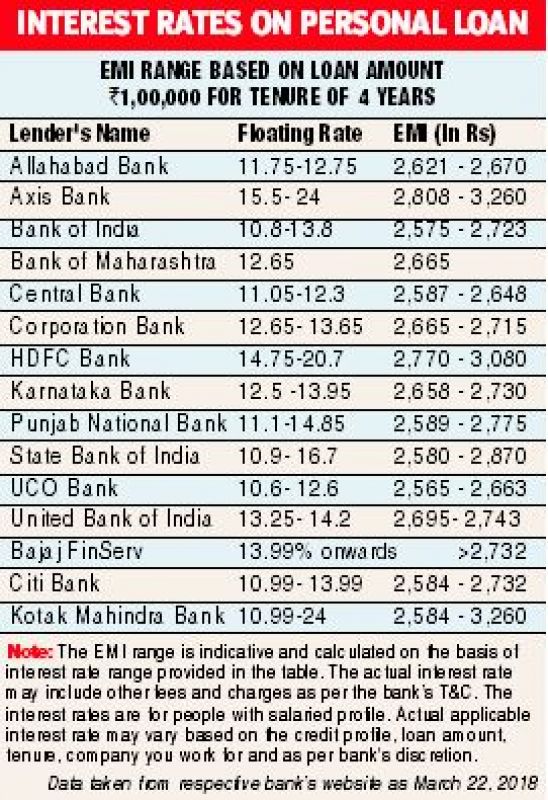

INTEREST RATES BOTTOMING OUT

Interest rates have hit rock bottom and are now climbing again. This means many things. It means your fixed deposits will pay better. It also means your loan EMIs will get bigger. However, if you're looking to take a home loan or a car loan, the best time was 2017. The second best time is now, as interest rates are still attractive.

BUY THAT HEALTH COVER

We have always advocated that you buy the best possible health insurance for yourself and dependent family members. This you should do not to save taxes but to protect yourself against the financial harm caused by hospitalisation and critical illness. This year, the government provided another big incentive for you to buy a fully-loaded policy. You can now claim up to Rs 50,000 in tax deductions under Section 80D towards premium paid on a health insurance plan for your senior citizen parents (or for yourself, if you are a senior citizen).

NO ESCAPING THE TAX MAN

The digital age is upon us. There is no escaping the long arm of the law. In 2017-18, we saw all financial services being linked to Aadhaar. Now, it is much harder to evade taxes. It is best for the common man to keep his financials in order, declare his income correctly, and pay the appropriate tax dutifully.