India Inc earnings lag in Modi era, but valuations soar

Mumbai/Bengaluru: Prime Minister Narendra Modi’s moves to cut red tape and streamline the tax system have won him plaudits, but data shows that the Modi government’s pro-business agenda has failed to translate into earnings growth for most Indian corporations.

As TCS and Infosys get set to kick-start another earnings season--the last under Modi’s current tenure--expectations remain muted. Yet, Indian stock markets trade near record highs and many investors remain upbeat.

“Interest rates have fallen quite drastically and retail investors are left with less choice,” says Krish Subramanyam, Co-Head, Equity Advisory at Altamount Capital. “Equities have been a preferred investment, and having Modi has kept markets buoyant.”

Foreign inflows into Indian equities were a net $6.7 billion in January-March, more than reversing outflows of $4.4 billion in 2018.

The NSE Nifty has risen about 7 percent this year, and about 63 percent since Modi took office in 2014.

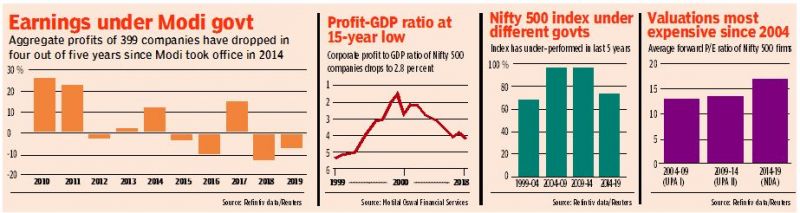

The stock market has rallied without support from earnings. Aggregate data on 399 of India’s largest listed companies for which comparable data is available shows earnings have fallen in four of the five years of Modi’s tenure, whereas they rose in four out of the five years his predecessor Manmohan Singh was prime minister.

The data, sourced from Refinitiv, also shows that on average, earnings rose 11.94 per cent annually under the prior government, while they fell 3.72 per cent during Modi’s time.

“The underlying earnings trajectory is not even average, it’s one of the worst,” said Gautam Chhaochharia, Head of India Research and a Managing Director at UBS.

Big structural changes such as the ban on high currency notes and the launch of GST have hurt growth in the economy, say analysts.

The ratio of corporate profit to gross domestic product (GDP) for companies in the Nifty 500 Index was 2.8 per cent in 2018, the lowest in 15 years, according to a report by Motilal Oswal Securities.

Modi took office on a wave of optimism he would change India’s economic fortunes. Although India has not grown at the anticipated pace, investors remain hopeful his reforms will pay off eventually.

The nearly 75 percent rise in the Nifty 500 index during Modi’s tenure also reflects a flight of money from traditional investments such as real estate and gold into shares following his shock 2016 ban on high-value bank notes.

Still, the performance lags that during each term of Congress-led coalitions, when the Nifty 500 rose nearly 100 percent.

A market rally without an earnings recovery has meant that, based on price-to-earnings ratios, Indian companies are at record high valuations.

On average, the Nifty 500 index has traded at a P-E ratio of 18 in the past five years, much higher than the 14.22 level during the prior government.