PSBs depend on Centre

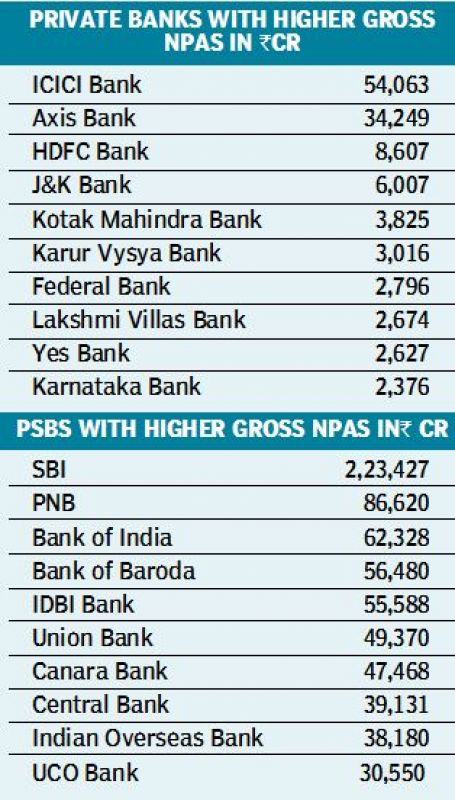

Mumbai: As much as Rs 5 lakh crore of bank loans deteriorated into non-performing assets (NPAs) in fiscal 2018, taking the total slippages in the past three fiscals to Rs 13.6 lakh crore, rating agency Crisil said on Tuesday.

While the banking system’s provisioning cover (excluding write-offs) for NPAs increased to 50 per cent as on March 31, 2018 compared with 45 per cent a year back, the rating agency noted that the higher provisioning and the resultant losses have materially eroded the Rs 1.2 lakh crore of capital raised by PSBs last fiscal.

It said that PSBs remain highly dependent on the government for capital to meet Basel III norms. Given the higher-than-expected losses last fiscal, probable loss in the current fiscal, and recall of the Additional Tier 1 instruments by a few PSBs, the '2.1 lakh crore recapitalisation program announced in October 2017 may be insufficient to meet the capital requirements of PSBs by the end of this fiscal.