Internet Banking is one of the oldest modes for online merchant payment transactions. It is a preferred channel for payments like income tax, insurance premium, mutual fund payments, e-commerce, etc.

At present, such transactions processed through Payment Aggregators (PAs) are not interoperable, i.e., a bank is required to separately integrate with each PA of different online merchants. As a result, if

a customer wants to make payment from his bank account to a certain merchant, the merchant’s PA and customer’s bank must have an arrangement. Given the multiple number of payment aggregators, it is

difficult for each bank to integrate with each PA. Further, due to lack of a payment system and a set of rules for these transactions, there are delays in actual receipt of payments by merchants and

settlement risks.

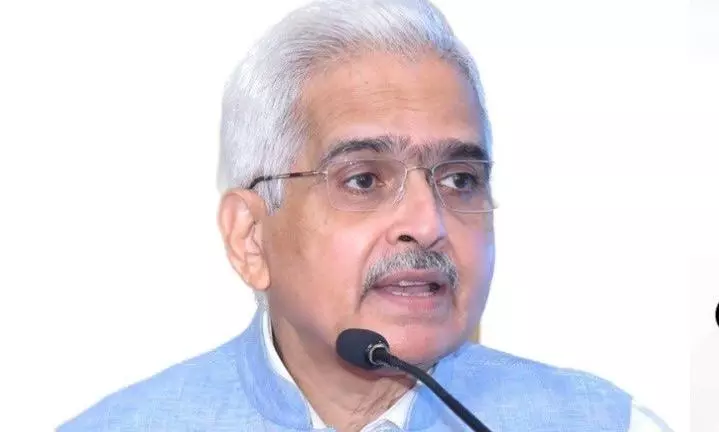

“Keeping in view these bottlenecks, in our Payments Vision 2025, we had envisaged an interoperable payment system for internet banking transactions. In pursuance of this objective, we have given approval for implementing such an interoperable system to NPCI Bharat BillPay Ltd (NBBL). We expect the launch of this interoperable payment system for internet banking during the current calendar year. The new system will facilitate quicker settlement of funds for merchants,” said Das while speaking at the Digital Awareness Payments Week.

The governor remarked that digital transactions in India have grown 90-fold in 12 years. India accounts for nearly 46 per cent of the world’s digital transactions (as per 2022 data). He said that UPI is

the biggest contributor to the growth of digital payments in India processing close to 42 transactions in a day.

Das urged all stakeholders like industry, payment system operators, media, digital payment users, and others to take up the responsibility of fulfilling the mission of ‘Har Payment Digital’.