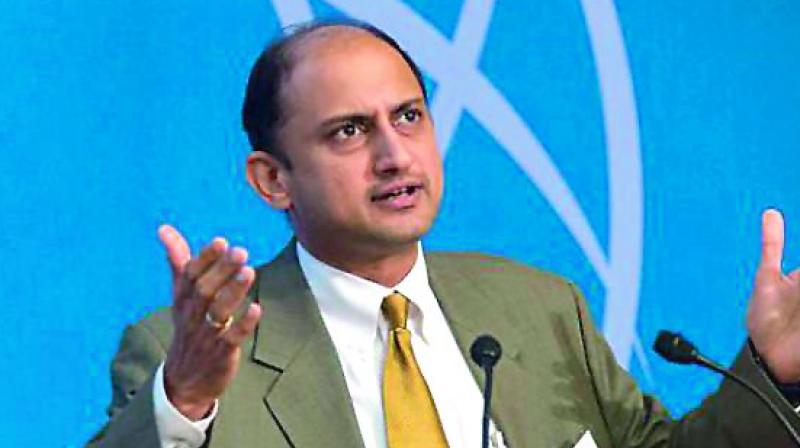

Viral Acharya is RBI's Deputy Governor

The 42-year-old Acharya's appointment for a three-year tenure was cleared by the Appointments Committee of the Cabinet.

New Delhi:The government on Wednesday appointed Viral V. Acharya, a New York University economics professor who once called himself “poor man’s Raghuram Rajan”, as new Deputy Governor at the Reserve Bank of India.

The 42-year-old Acharya’s appointment for a three-year tenure was cleared by the Appointments Committee of the Cabinet. He is taking over at a time when the central bank is facing criticism for repeated changes in the rules related to deposit and withdrawal of money, post-demonetisation.

He will fill the post that fell vacant after Mr Urjit Patel was made RBI governor to succeed Mr Rajan with effect from September 4. The existing three deputy governors of RBI are S.S. Mundra, N.S. Vishwanathan and R. Gandhi.

Like Mr Rajan, Mr Acharya also comes from an academic background and has also co-authored in the past at least three papers with the former RBI governor. These papers included ‘Sovereign debt, government myopia, and the financial sector’, ‘The Internal Governance of Firms’ and ‘Government Myopia and Debt in a Dynamic Setting‘.

Viral Acharya too favoured independence of banks

Mr Acharya has often praised former RBI governor Raghuram Rajan for his works and once said, “Raghu has been a great source of inspiration for me”.

While giving a Deutsche Bank Prize in Financial Economics plenary lecture in 2013, Mr Acharya had narrated an incident when someone asked him on a flight whether he was Raghuram Rajan, after seeing him, an Indian, with papers on banking and crisis. He quipped that was the day when he realised that if he had Mr Rajan as a “role model” and could get even 5-10 per cent of him, he could have easily passed off as “poor man's Raghuram Rajan” on flights.

Just like Dr Rajan, Dr Acharya has also been a strong votary of the independence of central banks and favoured them being “democratically accountable, yet be operationally independent from political influence”.

Mr Acharya is known for his research in theoretical and empirical analysis of systemic risks of the financial sector, its regulation and genesis in government-induced distortions.