A rainy-day giveaway from central bank

While that controversy is real, it can wait for another day.

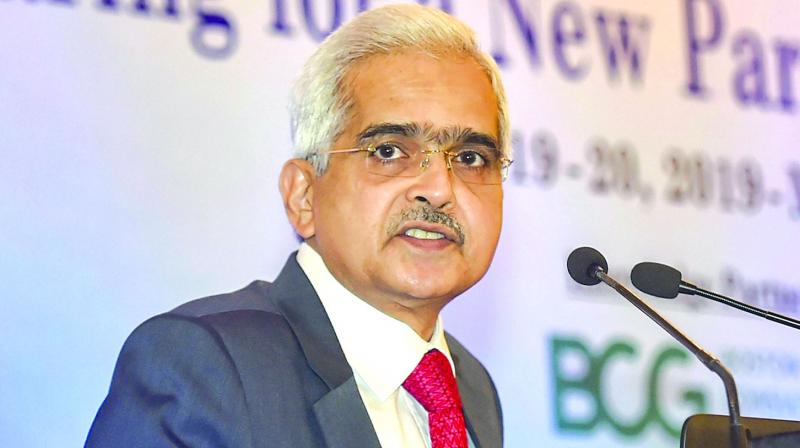

If he were the CEO of a corporation, Shaktikanta Das would be an investor darling.

His first full-year results, and Das is already returning more money than the entire dividend his two predecessors could muster between them in the previous three years. That’s just the kind of performance activist hedge funds like to see.

But Das isn’t a corporate CEO. He’s the chief of India’s central bank, and the record Rs 1.76 lakh crore ($24.4 billion) he’s going to deposit in the government’s account is bound to revive a debate about the threat to the monetary authority’s independence.

While that controversy is real, it can wait for another day. I view the bumper dividend as Das lending his spare umbrella to a government that has long lived in denial of the gathering clouds, believing GDP numbers that are too sunny to be trustworthy. Now that bad news is suddenly pouring down on the economy, it finds itself without shelter. The central bank is coming to its rescue, and without running any immediate risk of exposure to its own credibility.

That’s my benign interpretation. Consider the more sinister one. As recently as last month, the government was anticipating a Rs 90,000 crore payment from the RBI, which was already 80 per cent more than in the previous year. For it to end up with almost double (1) the budgeted amount smacks of pressure. If this had really been a shakedown, though, the outcome could easily have been a lot more shocking.

One of the reasons behind previous RBI Governor Urjit Patel’s surprise resignation last December was a campaign by a top Finance Ministry bureaucrat to raid as much as Rs 3.6 lakh crore of the RBI’s capital by taking even some of its revaluation reserves. Such a move would have left the institution at the mercy of an occasional capital injection from the government, crimping its operational freedom.

Thankfully, the final decision went to a committee. On its advice, the compromise now being implemented will leave the revaluation reserves intact. Only the coupons and profit on sales that the RBI has actually realized on its assets – foreign bonds, Indian government securities and gold – will be shared more liberally with the government. And that’s only after topping up contingency reserves so they don’t fall below 5.5 per cent to 6.5 per cent of the central bank’s assets.

These are separate from revaluation reserves and, in the RBI’s own words, are there to provide protection against the proverbial rainy day. By choosing to drive contingency reserves of 6.8 per cent down to the lower end of the safe range, Das has eked out an extra Rs 52,600 crore. It’s money Finance Minister Nirmala Sitharaman badly needs. Private investment slumped long ago. Now even consumer spending on everything from cars to cookies is threatened. The government’s tax collections are falling badly behind its rosy targets, leaving fiscal pump-priming impossible.

The extra money can buy time to halt the slide into a full-blown crisis and must not be wasted on a thoughtless carnival of new government spending. New Delhi should overhaul its 2017 goods-and-services levy, and not just slash tax rates in a panic and repent when already-tepid collections falter.

Recapitalising banks with an immediate infusion of Rs 70,000 crore is a fine idea, but the snail’s pace at which corporate bankruptcies are getting resolved – outside and inside the court system – is destroying value for lenders. Also crying out for attention is the shambolic real-estate market, which is infecting balance sheets of developers, financiers, households and investors.

Das has already gone for the smallest capital buffer possible. If the RBI’s assets increase next year while income on them doesn’t rise proportionately, he’ll have to replenish equity. Any pressure from the government to maintain the lofty dividend will then be viewed by investors as an attack on the RBI’s credibility.

The RBI governor’s spare umbrella may give the Indian bond market a modicum of hope today. Still, any optimism will fade quickly if the government leaves him shivering in the rain tomorrow.