Why tenants should go for a home insurance

Before taking a furnished house on rent try to convince house owner that he should get goods insured.

Unlike in most developed countries, home insurance penetration in India is very limited. This could be due to lack of awareness or perception of low risk. Home Insurance is divided into two broad categories -- structure Insurance and content (goods) Insurance. While the first refers to insurance protection against damage to the structure of a house, the second covers valuable goods that may be kept in the house such as furniture, electronic gadgets etc. Ideally, the house owner should buy a comprehensive home insurance which would cover both structure and content. But in many cases, house owners do not get goods insured, particularly when they put the house on rent. If you are a tenant, you may think why you should get the goods insured if they do not belong to you. But smart tenants think differently. Following are the reasons why a tenant should get goods insured:

Insure content (goods) of your rented house

Before taking a furnished house on rent, try to convince the house owner that he should get the goods insured. If he does not, it is advisable that you get it done yourself because safety and security of the goods kept in the house is your responsibility and you will have to pay if any damage is done to any goods. This is because rent agreements generally have a clause which says that all the goods such as furniture, refrigerator, air conditioners, etc. should be returned in good condition at the time of vacating the house.

In case it is not a furnished house that you have rented, it is all the more important that you get a comprehensive insurance cover done because the goods belong to you and you must protect them against any possible mishap.

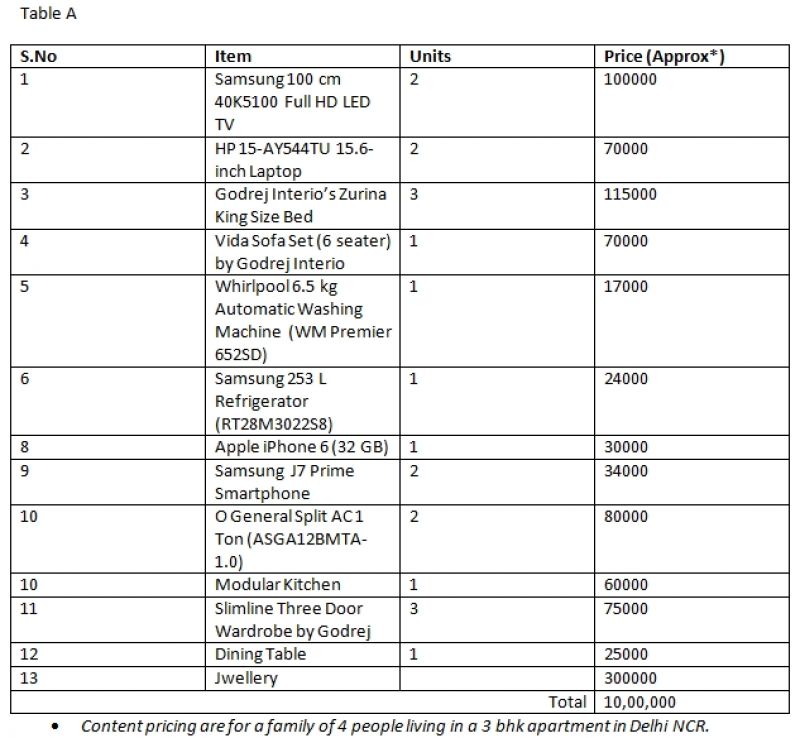

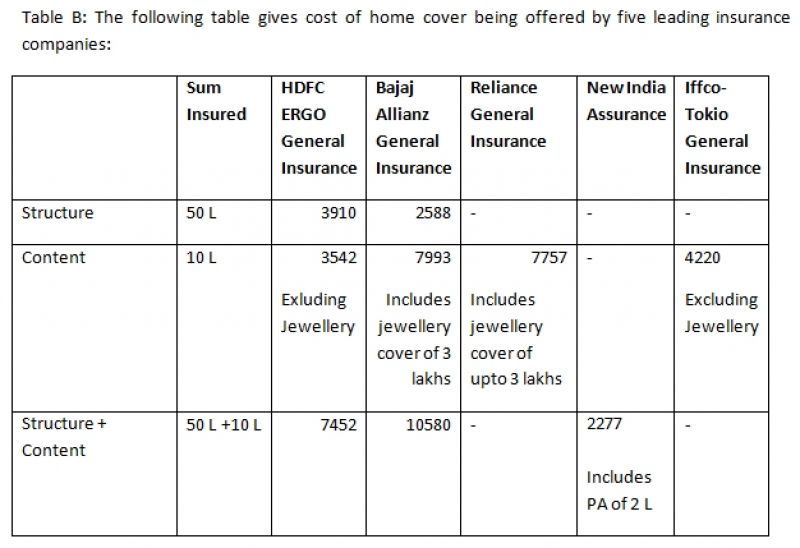

Table A gives details of an average family’s household possessions and their estimated cost, and Table B provides cost of home insurance being offered by top 5 insurers:

Table A

Liability factor

Existing rules say that if you are living in a rented house, and any mishap happens there, you will be liable for that. For example, if your guest gets injured in the house due to any reason and sues you for the damages, you will have to pay up the same. But if the house is insured, the insurer will pay your liability to the third person.

Similarly, if the damage is done to the structure by you or your guest, home insurance will take care of it.

Cover Theft

Another area where home insurance comes handy is theft. The theft risk is generally greater than that of natural or manmade disasters, and the best part is that the theft insurance cover works even in cases where the tenant could be out of the station at the time of the theft. However, there are few limitations to the sum assured in case of theft. You are required to declare the complete list of your belongings to the insurer at the time of purchasing the insurance policy and things which are not declared in the list won’t be covered. Items like jewellery and cash also have certain sub-limits which vary from insurer to insurer.

— By Neeraj Gupta- Head of Motor and Home Insurance, Policybazaar.com