Loans above Rs 250 crore will be monitored: Rajeev Kumar

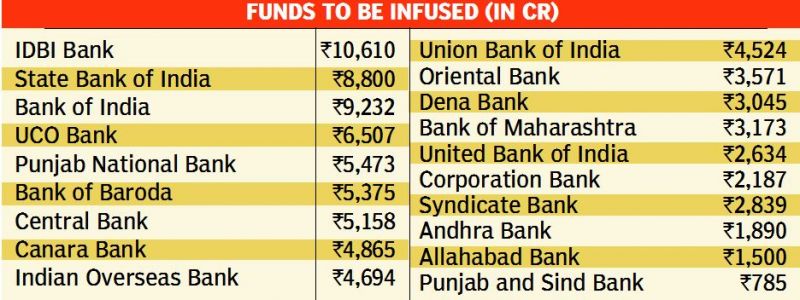

New Delhi: As part of its recapitalisation roadmap, the finance ministry said on Wednesday that Rs 88,139 crore will be infused in 20 public sector banks (PSBs) in the FY18.

Speaking to the media, finance minister Arun Jaitley said: “Now the entire object of this exercise is that the government has the prime responsibility of keeping the public sector banks in good health.”

The finance ministry said that the Rs 80,000 crore recapitalisation bonds, to be issued to PSBs, will not have an impact on fiscal deficit as they will be cash neutral.

Economic affairs secretary S.C. Garg said that these bonds will not have Statutory Liquidity Ratio (SLR) and have tenure of 10-15 years. SLR is a portion of deposits that banks need to invest in government securities.

Rajeev Kumar, secretary, department of financial services, said bank recapitalisation is dependent on performance and reforms undertaken by the lenders.

He said loans above Rs 250 crore will undergo special monitoring and red flags whenever the original covenants of the loans are violated. Bank have also been instructed to become more professional.

The ministry would gauge the performance of banks on parameters like customer responsiveness, responsible banking, credit offtake, MSME lending, deepening financial inclusion and digitalisation.