RBI orders banks to replace existing magnetic strip cards with smart chip

About 32 lakh debit cards have allegedly been exposed to malicious software in the biggest ever security breach.

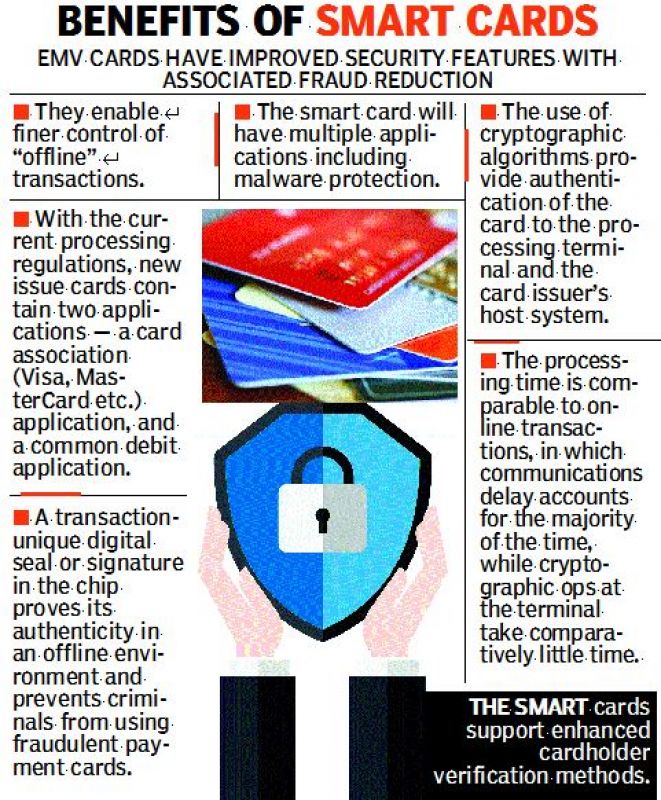

Hyderabad: With the increase in the theft of debit and credit card data, the Reserve Bank of India (RBI) is insisting on bankers to replace existing magnetic strip cards with smart chip EuroPay, Master and Visa cards.

About 32 lakh debit cards have allegedly been exposed to malicious software in the biggest ever security breach in the country, and banks say that all these are magnetic strip cards that have fewer security features.

The RBI had directed banks to issue smart debit cards in 2013 replacing magnetic strip cards as the chip cards have to be authorised by punching the PIN while making purchases. It has been extending the time for the shift to chip-and-PIN cards. In a recent circular, it told bankers that the shifting process has to be completed, irrespective of the validity period of the existing card, by December 31, 2018.

Mr M.S. Kumar, secretary for All India Bank Employees Association for AP and Telangana, said the smart chip cards had more security features which could not be cracked by hackers through malware or skimmer machines.

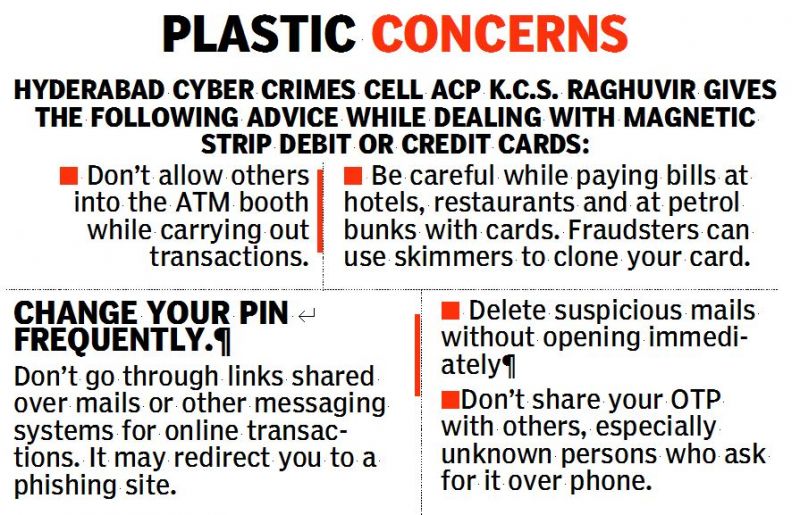

“In many cases related to online frauds or cloning of cards, the cards did not have smart chips. By using skimmers, hackers or fraudsters can steal details of customers including the PIN in cases of magnetic strip cards. Using those details, they can clone the card,” he said.

He advised bank customers to migrate to smart chip cards. “A few banks have upgraded the e-banking system which asks security questions when the system identifies a suspicious login or transaction from the IP addresses. Banks have started sending SMS and emails to their customers for migrating to smart cards,” he said.