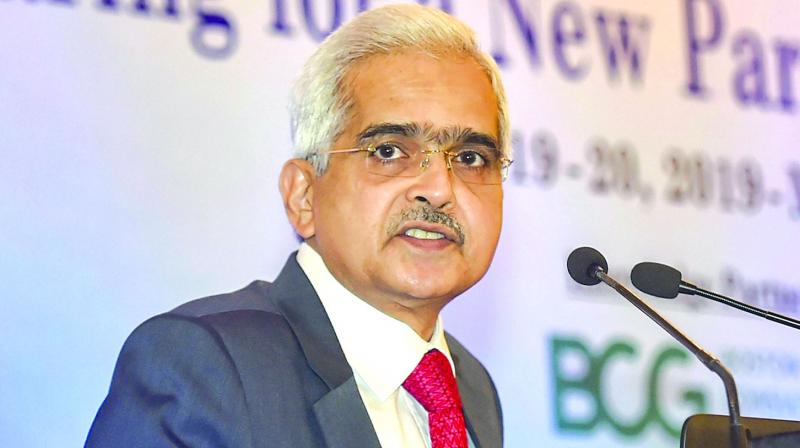

Shaktikanta Das for speedy move to repo-based rates

Governor rules out asset quality review of NBFCs.

Mumbai: The Reserve Bank of India Governor Shaktikanta Das on Monday urged banks to move faster on linking their lending and deposit rates to the repo rate for faster monetary transmission to boost economic growth. Observing while some banks have announced that they are linking their lending rates with the repo rate with respect to new loans, Das said, "Our expectation is that they should move faster."

"It started with State Bank of India (SBI) and now other banks are also doing it. They have linked new loans to the external benchmark to the repo rate. I expect more initiatives and this process to get faster. Time may come, I think, perhaps we need to formalise this arrangement," Das added. He was speaking at the annual Ficci-Indian Banks Association Conference.

So far several banks, including State Bank of India, Bank of Baroda, Union Bank, Bank of India, Andhra Bank, Syndicate Bank, Indian Overseas Bank, have announced linking loan and deposit rates to the benchmark repo rate.

The RBI has cut the policy repo rate by a cumulative 75 basis points between February and June 2019, however, banks have passed on only 29 basis points in the same period. RBI had postponed making external benchmarking mandatory as banks were dealing with bad loans which was putting a strain on their profitability.

Das ruled out ordering an asset quality review of the large NBFCs, says the RBI is not thinking about conducting one for now as it had done for the banks in late 2016 and early 2017, under which it identified 40 largest stressed acco-unts and asked banks to send for bankruptcy resolution.

"At the moment there is no such proposal to have an asset quality review on NBFC but while saying that let me also add that 500 odd NBFCs and HFCs are closely being monitored by us and our monitoring and supervision include all aspects of their functioning, including their capital adequacy, stability, their cash inflow, outflow," Das told reporters.

He said the RBI is keeping a close watch on the interconnectedness of banks and non-banking finance companies and reiterated that the monetary authority will not let any of the top 50-odd NBFCs to fail.

"It is our endeavour to ensure that no large NBFC collapses," Das reiterated and said the objective of the RBI is to harmonise the liquidity requirements for banks and non- banking finance companies.

"It is our endeavour to have an optimal level of regulation and supervision so that NBFCs are financially resilient and robust. We will not hesitate to take whatever steps are required to maintain financial stability in the short, medium and the long term."

Speaking about the resolution of the Monetary Policy Committee, Das re-called that the Committee specifically mentioned that growth is the highest priority. RBI has taken a number of steps to inject growth impulses in the country. "Having said that growth is a matter of highest importance, it is also important to look at issues of financial stability, because long term growth can be sustained only by stability of the financial sector." Hence the focus of the RBI and the government are to allocate economic resources efficiently, manage financial risk and ensure that industry has the capability of performing even in the presence of external financial shocks.

Das cautioned the gathering that weaker than expected growth is one of the key risks in global financial stability.