Factors you should consider when buying a term plan online

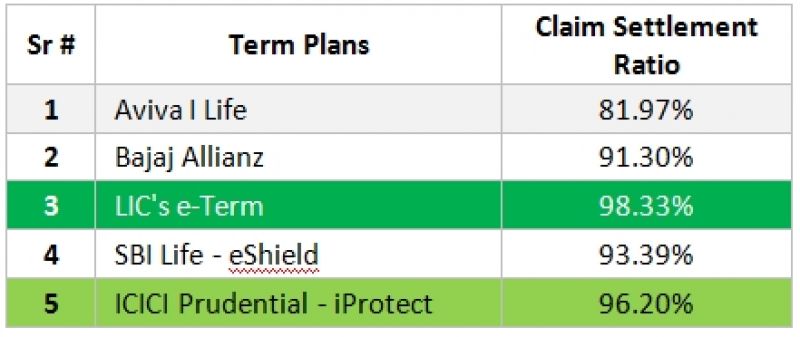

1. Claim Settlement Ratio: This ratio shows the percentage of claims granted out of the total filed in the year (usu. Financial Year). The higher the ratio, the more hassle-free it’ll be for your dependents to claim the insurance in your absence and continue their lives comfortably.

This is an important parameter to consider in your decision for the life insurer. Since the purpose of life insurance is to secure your dependents’ future, low claim settlement ratio might lead to disappointment later.

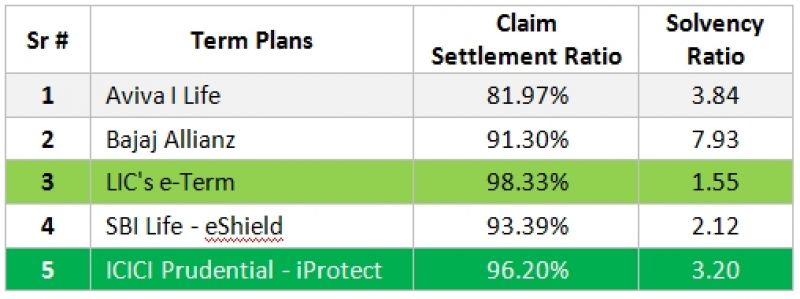

2. Solvency Ratio: Solvency ratio shows the financial strength of the insurer. Meaning; whether the insurer will be able to settle your claim or not if and when it arises.

Again, the higher the ratio better it is. But this ratio should always be looked at with the Claim Settlement Ratio. As the claim payments reduce the financial assets of the insurance company, a high claim settlement coupled with a good solvency ratio will certainly be an indicator of a better insurer.

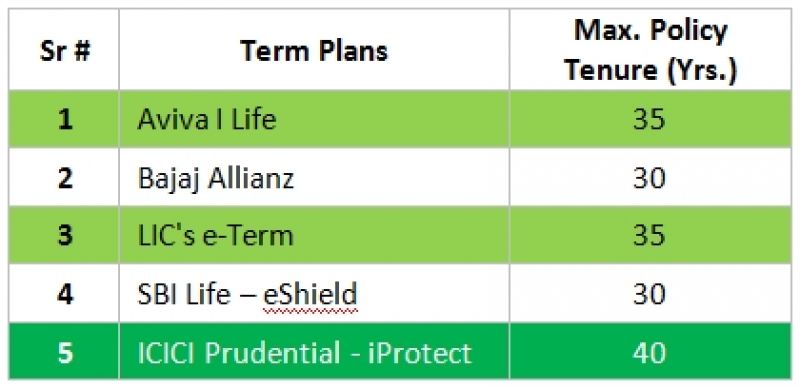

3. Maximum Tenure Available: The greater this number is, the better. However, you may want to insure yourself till the retirement age only. Therefore, this factor will affect your choice if you feel that there is a chance of extended employment or liability such as home loan, etc.

4. Additional Covers & Benefits Available: There are many situations that can lead to financial instability other than death. For example, dismemberment of a body part, paralysis, critical illness, etc. Here are some additional benefits that can be availed with online term plans to cover such situations:

A. Critical Illness: Ranging from heart ailments to disabilities critical cover benefit may include anywhere from 10 to 40 different life-threatening diseases.

B. Waiver of Premium: Insurance cover will continue without the need to pay the premium in case of permanent disability.

C. Accidental Death: This benefit increases the sum assured to be paid to your family members in case death occurs due to an accident.

D. Income Benefit: Some term plans allow your family members to receive a regular income from the plan rather than a lump sum amount which they’ll have to invest later to receive income.

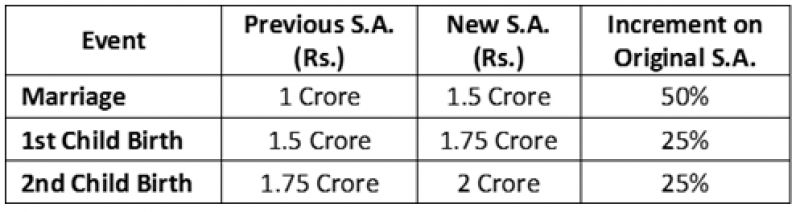

E. Life-Stage Increments to Insurance: As you cross over to different life stages, your responsibilities increase and so should your life cover. For example: Marriage, child-birth are life events when you should increase your life cover.

Illustration of Life-stage Increments in Term Plans: Assuming you subscribe to a Rs 1 Crore sum assured when you start working, you can increase your life cover under an online term plan (with life-stage increment feature) as follows:

5. Premium Cost: Cost is an important factor to consider, once you have finalised the benefits you are looking for. But, cost comparison should be accompanied with the benefits, solvency of insurer and claim settlement rate:

* Annual premium for a sum assured of Rs 50 Lakhs for 30 yr. old smoker male. Policy term is 30 years.

Disclaimer: All calculations and data are for illustration purpose only. (See ICICI Pru Life’s Term Insurance Calculator for more accurate calculations for yourself.)

How to Decide Your Sum Assured?

Sum assured decision rests on your current age, family’s expenses, and future goals. For example: If you are 30 years of age with monthly household expenses of Rs 35,000 (household expense excluding your personal expenses), you will need a term cover of approximately Rs 1 crore. This much insurance will ensure that your family is able to maintain their lifestyle and achieve their financial goals even after you are not there to ensure the same.

You can use the given example as a base for calculating your own sum assured, however, you should know that most insurers limit the maximum sum assured at 20 times of your current annual income.