Best investment treats for the kids

You need to invest in different asset classes depending on your needs.

Children’s future is one of the most important elements of our financial planning. Let’s lay a roadmap for the future.

No parents want to deprive their children of required resources as they grow. A large part of people’s lifetime investments are targeted at helping their children achieve their dreams. The financial planning for children should start from the first day of their birth.

Parents should take care of children’s health security, education requirements, higher studies, marriage and career settlement while considering various factors under the investment planning. It is important to take care of children’s every requirement while drawing the investment plan.

Why investment planning is required

You may find your current income to be sufficient for meeting all your present expenses, but things may not be as comfortable in the future. Remember that inflation consistently depreciates the value of money, and your expenses could grow manifold in the years to come. Today you may easily buy a car worth Rs 5 lakh from your current income but the same car would cost Rs 9.83 lakh after 10 years, if the inflation remains around seven per cent per annum.. Therefore, by investing, you can use the power of compounding to increase the corpus over and above the rate of inflation so that you can meet your future expenses easily.

It is important that you set a goal before you start investing. If you want to take care of your children’s future expenses, consider it as a goal and make an investment plan targeted to achieve it in optimum time.

Suppose your child’s age is five years old and now you want to invest keeping in mind their future expenses. Let’s explore various things that you should consider while investing for the child.

College Education

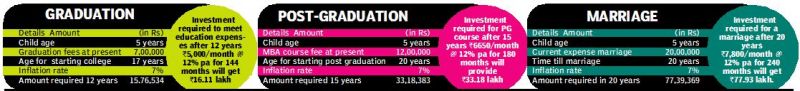

After completing schooling, getting your child admitted to a college for undergraduate studies will be one of your major future expenses. The current fund requirements for an engineering degree is Rs 7 lakh or more. Assuming that your child would attend such a course after 12 years, and assuming that the average inflation rate is seven per cent through these years, the fund requirement would be Rs 15.76 lakh.

As mentioned in the illustration below, you need to invest Rs 5,000 per month for 144 months in an asset earning you 12 per cent per ann-um to achieve this target.

You can invest in a large cap equity fund SIP for returns of 12 to 14 per cent per annum. You can invest in a long term debt fund to earn a return of eight to 10 per cent. You must review your corpus requirements periodically and adjust your investments accordingly.

PostGraduate Education

The present cost of post-graduate courses varies depending on the stream. For a management degree, it could cost around Rs 12 to Rs 15 lakh for a two-year course.

As mentioned in the illustration, you would need to invest Rs 6,650 for 180 months at a 12 per cent per annum return to make a corpus of Rs 33.55 lakh for your MBA programme. The corpus could also be achieved with lesser monthly investment, but it would require higher return. Hence, you need to take higher risk or keep invested for a longer tenure.

You can achieve the 12 per cent return by investing in asset classes like diversified equity fund SIP, index fund SIP, debt mutual fund, SGB gold investment ETC. You should select the investment based on the amount and your risk appetite.

Amount required for marriage at 25-year age

As your child attains 25 years, then you would require huge sums for their marriage. The present day expense in a marriage is Rs 20 lakh. The amount required after 20 years, when the child is 25 years of age, would be Rs 77.39 lakh.

Since it is a long tenure, it would need periodical swit-ching and consistent monitoring. Achieving a return of 12 per cent in the long term would require low to moderate risk.You have the option to invest in an index fund SIP, long term debt fund, SGB gold and PPF.

If you have a girl child, you must consider the Sukanya Samriddhi scheme, where you can invest for 14 years and have fund maturity after 21 years of starting investment.

Things to keep in mind

While investing for the child’s future, you need to remember that equity mutual fund, direct equity, and gold investment are linked to the market performance and therefore returns are not assured. Depending on the market performance, your returns could be high or low. Schemes such as PPF and SSS carry low risk, but the return is lower than the required rate. So you should invest in a combination of all best available investment instruments while considering your risk appetite and their returns-generating capacity.

For short term requirements, you can opt for debt instruments as they provides secured return. For medium and long term, you can make a combination of debt and equity instruments for higher returns.

Start investing for your child as early as possible after their birth. Do not mix other financial goals with the ones for your children.

(The writer is CEO of BankBazar.com)