US retailers pamper customers with loyalty schemes

Bengaluru: With private fitting rooms, members-only stores and clever apps, US department stores are reinventing their old and tested loyalty programmes to fend off the challenge from online rivals.

Over the past two years, major US retailers, including Macy’s, Nordstrom, Kohls Corp and others, have spent billions of dollars to overhaul existing programmes or launch new loyalty schemes.

According to estimates compiled by market intelligence firm Beroe, the US loyalty programme market was worth between $47 billion and $55 billion in 2018 in terms of spending by companies and sector analysts expect it to keep growing by 2 per cent to 4 per cent a year between 2018-2020.

Data from research firm LoyaltyOne showed retailers now invest at least 2 per cent of their total revenue on loyalty programmes and double that or more on related customer targeting and analytics. Department stores and apparel retailers typically invest more than the others.

Its report “Loyalty Big Picture” based on an international survey of 1,200 loyalty plan providers and some 4,500 members said 69 per cent of executives reported a rise in spending on royalty schemes over the past two years, and 55 per cent expected a increase in investment in the next two years.

Around in some form for over a century, loyalty programmes have long relied on a simple concept— reward shoppers with coupons, discounts, prizes or air miles and they will come back. E-commerce has changed that.

It has made shopping around for bargains easier than ever while Amazon’s Prime programme set a new benchmark with perks, such as free two-day shipping, video streaming or cloud storage.

Just last month, Amazon raised the stakes again announcing it would spend $800 million to ensure one-day delivery for its Prime members.

“In the age of Amazon, it’s very much ‘what have you done for me lately type of retail environment’,” Matt Lindner, Senior E-Commerce Analyst at Mintel.

“The challenge these retailers are facing is how do you offer attractive rewards without totally compromising your bottom line.”

Realising that expensive advertising is unlike to win back shoppers lost to online rivals, traditional retailers have shifted their focus to retaining existing customers and making them spend more.

Those most successful have employed sophisticated data gathering and analytics to better tailor offers to customers’ tastes while providing perks that Amazon cannot match, such as private dressing rooms, members-only stores or beauty workshops.

“Retailers are finally realising that they need to respond to the ‘biggest and baddest’ loyalty programme in the market right now and that is Amazon Prime,” research firm Gartner Director Tom Gehani said.

They have done so over the past five years by combining revamped loyalty schemes with increased online presence, in-store pickup for online purchases, upgraded stores and new or improved mobile apps that tie in with loyalty programmes.

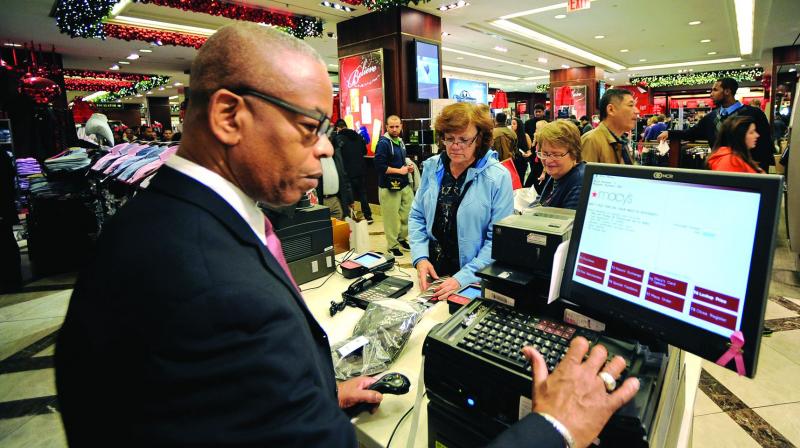

Macy’s, for example, relaunched its scheme in mid-2017 after 10 straight quarters of sales declines as a tiered plan with special privileges to its most loyal and big spending customers. The perks include ticketed seats to Macy’s Thanksgiving Day Parade sales, concerts, fashion shows and cooking classes.

“The programme is outperforming our expectation,” Macy’s Chief Executive Officer Jeffrey Gennette said in February.

Rival Nordstrom re-designed its customer loyalty programme, “The Nordy Club”, in October 2018. It offers more reward points, fast redemptions, curbside pickup of purchases, and perks such as beauty and style workshops or brands not available to other shoppers. Today, the programme’s 11 million members account for over half of its sales.

Members can also save items in an app that will send push notifications of their wish list once they get close enough to a Nordstrom store.

Brand retailers have also joined the fray.

J Crew launched its first rewards programme in July 2018 with free shipping while Nike has a members-only floor at its flagship store on Fifth Avenue in New York City.