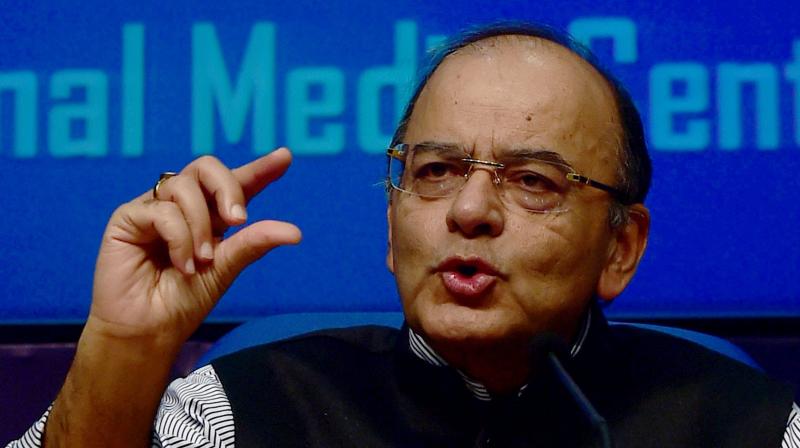

Arun Jaitley confident about growth in economy

New Delhi: Union finance minister Arun Jaitley said that demonetisation of Rs 500 and Rs 1,000 currency notes is not an immunity scheme.

“The government and revenue department is keeping an eye on this. These reports are quite exaggerated. From yesterday midnight if someone converts such notes (by taking a commission), they too, later on, will have to account for, what is the source. So those who indulge in this trade are going to run a high risk,” said the finance minister.

Mr Jaitley said that demonetisation of Rs 500 and Rs 1,000 notes will expand the size of the economy, increase revenue base and make the system cleaner while preserving its credibility.

“The decision will expand the GDP and make (the economy) cleaner. It will push revenue and more money will come into the banking system”. Revenue secretary Dr Hasmukh Adhia said that government would get reports of all cash deposited between November 10 to December 30, 2016, above Rs 2.5 lakh in every account.

The department would do matching of this with income returns filled by the depositors and suitable action may follow. To a question that if department finds that huge amount of cash above Rs 10 lakh is deposited in a bank account, which is not matching with the income declared, secretary said: “This would be treated as the case of tax evasion and the tax amount plus a penalty of 200 per cent of the tax payable would be levied as per the section 270(A) of the income tax Act.”

He said that small businessmen, housewives, artisans, workers with less than '2 lakh don’t need to worry. “Such group of people as mentioned in the question need not worry about such small amount of deposits up to '1.5 or 2 lakh since it would be below the taxable income.

“There will be no harassment by Income Tax Department for such small deposits made,” said Dr Adhia. On dealing with the problem of people buying gold to hide their black money, he said the person who buys jewellery has to give his PAN number.

“We are issuing instructions to the field authorities to check with all the jewellers to ensure that this requirement is not compromised. Action will be taken against those jewellers who fail to take PAN numbers from such buyers. When the cash deposits of the jewellers would be scrutinised against the sales made, whether they have taken the PAN number of the buyer or not will also be checked,” he added.