How personal accident insurance bridges gap between life and health policy

At 32, Rajan Singh was the most punctilious person I had ever met in my life. With a promising career going for him, completing the beautiful family picture was his amazing wife, Kanika and a cute four-year-old Pihu. Being a family man, he bought two insurance policies — term insurance and health insurance. Armed with both these policies, he was confident about the safe future of his family.

However, all is not so hunky-dory, and life always takes you by surprise. Rajan met with an accident that left him incapacitated for next eight months. While his health insurance took care of his hospitalisation expenses, for the rest, he had to dig into his savings. It was not the end of his ordeal. As the sole breadwinner was unable to work, things took an awry turn. As Rajan was alive, his term insurance did not help either. Suddenly, reality struck him hard and made him ask himself, “Where is the loophole in his insurance planning and is there something he could have done to deal with such type of situation?

Yes, there was a loophole in the insurance portfolio of Rajan. The situation would have been different if he had purchased a personal accident insurance policy.

A personal accident policy bridges an important gap between term and health insurance policies. While a term insurance policy takes care of your family in case of your sudden demise, it doesn’t offer any coverage if the policyholder is disabled due to an accident. Similarly, a health insurance policy covers your hospitalisation expenses up to a certain limit. However, in addition to medical costs, one may experience loss of income as well. To tide over these unforeseen expenses, it is essential to go for a personal accident insurance cover.

What does a personal accident insurance include?

A personal accident policy offers the following coverages:

Accidental death benefit: In case a policyholder dies in an accident, the insurer will pay 100 per cent sum insured to the nominee of the policyholder.

Total permanent disability: If due to an accident, a policyholder suffers from a permanent disability, like loss of limbs, eyesight or any other form of disability; he/she will get the sum insured.

Reimbursement of accidental hospitalisation expenses: If there is a minimum 24 hours of hospitalisation following an accident, the insured can approach the insurance company to compensate for the hospitalisation expenditure.

Accidental hospital daily allowance: Some insurance companies give per day allowance in case of hospitalisation to cover various expenses, including food, transport, etc.

Extra features: In addition to the traditional benefits, some personal accident insurance policies give the following benefits:

Legal and education benefits

Child education benefits

Injury caused due to terrorism

Transportation of mortal remains

How much is the premium?

Though you are convinced that a personal accident insurance is an important policy, you want to avoid it as you don’t want to spend extra money. However, let me tell you, personal accident policy is one of the most affordable insurance coverages available in the market. In fact, if your annual salary package is between Rs 4 and 5 lakhs, you will need to pay only Rs 774/month to get coverage of Rs 5 lakhs. This is equivalent to what you pay for a movie ticket of two with popcorn!

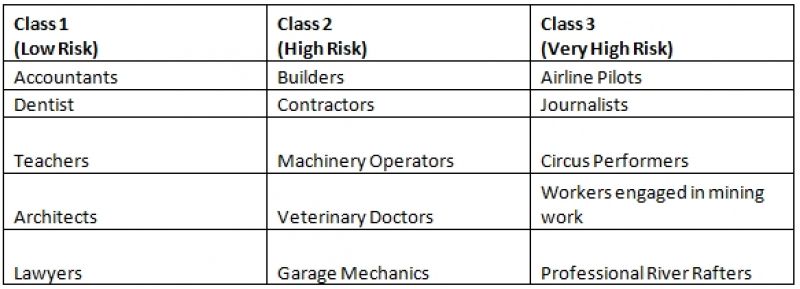

Unlike, other insurance policies, the premium of a policy doesn’t depend on the age of the policyholder. In fact, it is the occupation of a person that decides premium rates. It means a 50-year old teacher will have to pay the lesser premium amount as compared to a 25-year old machinery operator.

For calculating the premium, most of the insurers have categorised occupations under the following heads:

Is claim process tedious?

Not at all! The claim process of personal accident policies is easy and straightforward. You don’t need to take medical tests in order to prove your injury. While informing your insurer about the accident, you or your nominee need to submit contact details, policy number, date and time of the accident, location, and a brief account of the accident. Once you have submitted all the details, the insurer would review and disburse your claim.

Note, it is necessary that your family members are aware of all the policy details so that they can file the claim in your absence. In addition to this, it is important to inform the insurer about the accident within the fixed tenure specified in your policy document.

Should I go with standalone policy or a rider?

Now when you are convinced that you should have a personal accident policy, the next question which can trouble you is — standalone or rider?

In most of the cases, riders offer a limited coverage as they cover only the accidental death and permanent disability. But a standalone policy is comprehensive as it covers various kinds of losses, including partial or temporary disability and loss of income. Moreover, it is feasible to customise the standalone policy.

Further, some companies also offer group personal accident policies. However, personal accident coverage should be 5-10 times your annual income, but in the case of corporate policies, it may not be sufficient. Also, when you leave the job, the corporate cover will cease to exist, and there is no guarantee that your next employer will also cover you under the plan. Moreover, a group plan only covers employees, whereas, an individual plan can be extended to cover family members as well.

Conclusion

As said by Rashida Rowe, “Life is so unpredictable, it can bring you so much joy and yet at the same time cause so much pain”, but simple planning can prepare you to face all odds of life. While you can bank on your term insurance policy to take care of your family after your demise and health insurance to rescue you in the case of medical emergency, you should have a personal accident insurance to fill the gap between both these policies. In other words, to rescue you in the case of disability. We make it simple and easy for you to understand!