Financial planning

While planning is critical to our financial well-being, it has become inevitable in the uncertain times we now live in.

Plan of action

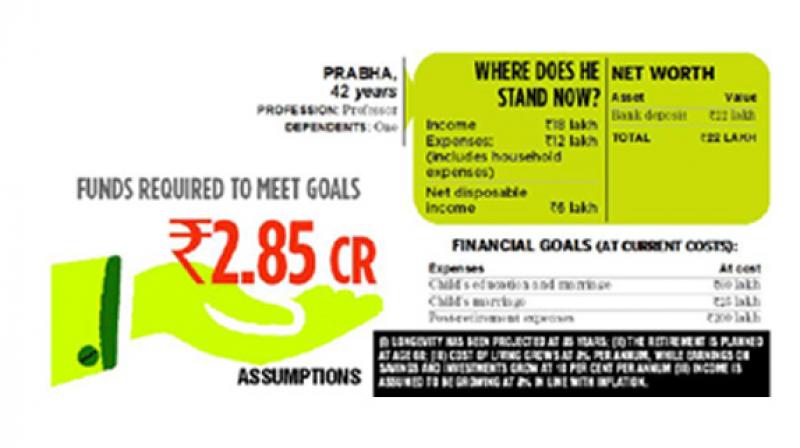

Disposable surplus of Rs 6 lakh needs to be invested every year for the next 15 years, until retirement, in the following proportion:

Term assurance of Rs 1 crore in the form of a keyman insurance, if permitted, may be taken for about 20 years which will cost about Rs 25,000 per year.

Contribute Rs 1.5 lakh per year in PPF in the name of her child for the next 15 years which will be valued at Rs 43.22.lakhs growing at the current rate of 7.80 per cent a year at maturity.

Unit-linked pension plan may be funded by the firm and bought so as to gain on an upside, with a 15 years horizon. A sum of about Rs 1,05,000 per year over 15 years will yield a future value of Rs30.79 lakh with eight per cent a year growth.

Investments may be carried out in a systematic investment plan of balanced (equity and debt) of Rs 25,000 per month aggregating to Rs 3 lakh over the next 15 years. This will help her in creating a corpus of Rs 45 lakh at cost (Rs 87 lakh) in value terms if growth is aimed at 8 per cent a year). This will help her to build up the retirement corpus. This fund can be placed in a safe debt fund to earn monthly dividends at retirement, which can be utilised to buy an immediate annuity.

PPF and pension plan can be used to buy an immediate pension policy at retirement.

(L. Ravindran is a certified financial planner and managing director of Wealthmax Enterprises Management Pvt Ltd. Readers can send their queries to ravind0099@gmail.com)