Financial planning

While planning is critical to our financial well-being, it has become inevitable in the uncertain times we now live in.

Plan of action

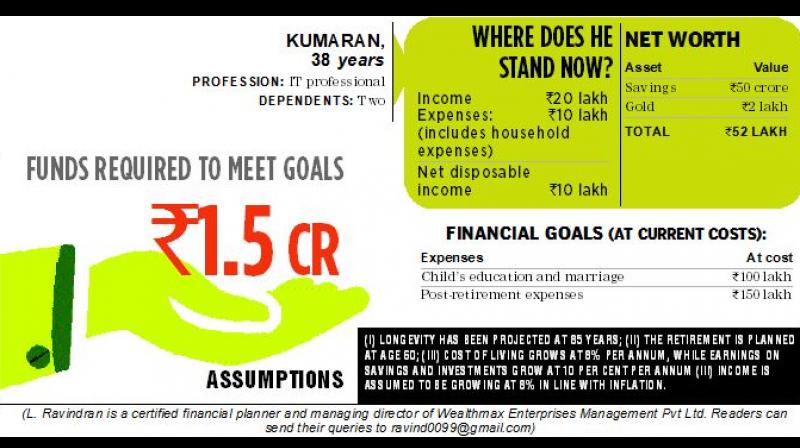

Term assurance of Rs 1.5 crore may be taken for about 30 years which will cost about Rs 26,000 per year. The disposable surplus of Rs 10 lakh every year may be invested for the next 25 years in the following proportion:

Invest in an SIP of balanced (equity and debt) of Rs 50,000 per month over the next 25 years. This will help in creating a corpus of Rs 1.5 crore at cost (Rs 4.72 crore in value terms if growth is aimed at eight per cent a year). This will help him to plan for his children’s marriage and retirement needs in full.

A sum of Rs 1.5 lakh be parked every year in a PPF yielding 7.6 per cent a year. Over 20 years, this will translate into a future value of Rs 70.6 lakh. This money can be placed in a debt fund from the age of 55-70 years and systematically withdrawn for later needs in life. If required, funds can be partially withdrawn for children’s higher education.

A sum of Rs 2 lakh can be saved in a short-term debt fund for five years growing at 7.5 per cent a year which can be withdrawn every five years to meet higher education of children and meet marriage expenses thereafter.

The EPF accumulation of '8 lakh with funding at same pace, earning 7.6 per cent and gratuity at retirement will fetch him about Rs 1 crore at retirement. The PPF at maturity can be used to buy a pension policy at retirement.

Bank deposits may be kept at bare minimum levels to meet contingency requirement for the next 25 years.