SBI joins the global league

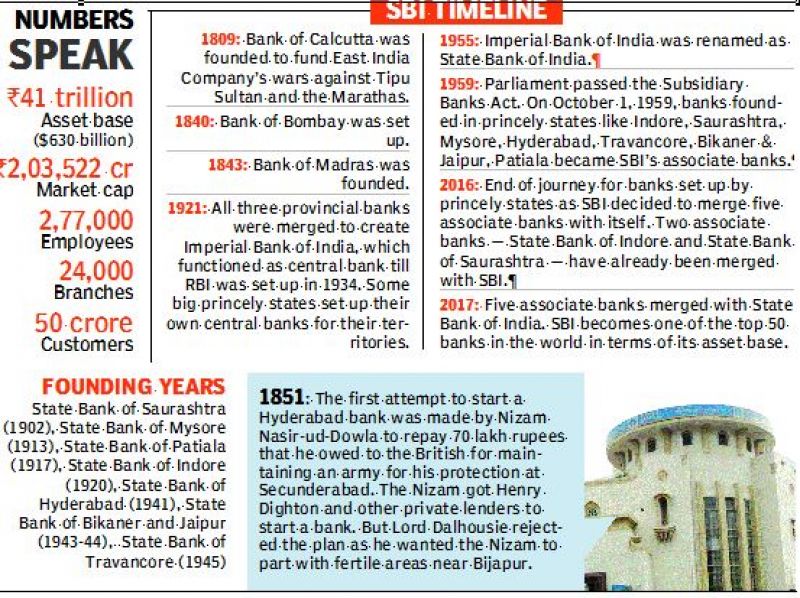

The combined entity will have a total of 2,77,000 employees, 24,000 branches and 50 crore customers.

Mumbai: India is set to get the biggest bank it ever had its history with a total balance sheet size of Rs 41 lakh crore with the merger of State Bank associate banks with its parent State Bank of India (SBI), coming into effect from April 1. This will also take SBI into the league of top 50 largest banks in the world.

In February, the government approved an SBI’s proposal to merge five subsidiaries with itself to create a banking behemoth in the PSU space overcoming stiff opposition from employees unions and a few political parties.

Those merged with the parent bank includes State Bank of Travancore, State Bank of Bikaner and Jaipur, State Bank of Mysore, State Bank of Patiala and SBH, which were once the central banks of the erstwhile princely states.

The combined entity will have a total of 2,77,000 employees, 24,000 branches and 50 crore customers. However, as part of cost rationalisation, the bank has planned to relocate around 1,800 branches following which 12,000 employees have been given an option to take Voluntary Retirement Scheme.

“Banking, the world over, has traditionally been a game of size and scale. The 10th largest bank in the world will still be nearly four and a half times larger than SBI even after the merger. For SBI to achieve its global aspirations; the size is a must and it is in this context that the merger of SBI and its subsidiaries must be viewed,” analysts at Angel Broking said.

The move, according to industry experts, would pave the way for the consolidation in the domestic banking sector as the government is strongly in favour of creating big global banks in India by merging small public sector banks grappling with high levels of stressed assets.

“Remember, this will be the largest merger among the PSU banks and will be the first step in the direction of consolidating banking operations in India. Since nationalisation, there has been tremendous duplicity of branch banking leading to over investment in business areas that do not generate adequate Return on assets. The merger gives a straight 30 per cent boost in assets to SBI without impairing its asset quality. In fact, the current level of seven per cent gross NPAs and under four per cent net NPAs of SBI is likely to be maintained post the merger,” Angel Broking added.

While there were over 50 princely state banks post independence, some of them were shut down, some were converted into cooperative banks while a few merged with SBI. After the merger, India will have 22 public sector banks, 22 private sector banks, 31 foreign banks, 86 regional rural banks, four local area banks, 1,721 urban cooperative banks.