Centre, RBI ask banks to step up lending to MSMEs

The RBI governor asked banks to take advantage of the MSME restructuring scheme to support viable MSME units.

New Delhi: In a bid to boost industrial growth and create jobs in the economy ahead of the Lok Sabha election, both the Centre and the RBI asked the state-run banks to step-up lending as its reluctance has impacted the liquidity situation in the market.

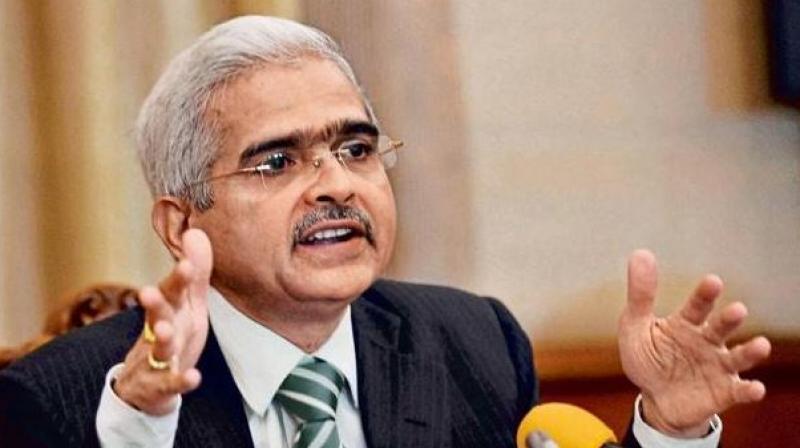

In a meeting, the RBI governor Shaktikanta Das urged the CEOs of state-run banks to avoid “excessive conservatism.” while providing loans.

The Centre too has been keen to increase lending especially to the medium and small enterprises (MSMEs), which are the major job creators in the country, were severely hit by the twin blows of demonetisation and GST.

During the meeting, Mr Das underlined the importance of public sector banks (PSBs) for the economy especially at the present juncture in helping meet broader economic goals. The RBI governor asked banks to take advantage of the MSME restructuring scheme to support viable MSME units.

Finance minister Piyush Goyal along with Department of Financial Services Secretary Rajiv Kumar also reviewed the performance of Public Sector Banks (PSBs).

“We have discussed measures to promote MSME loan, housing loan and agriculture lending,” said Mr Goyal after the meeting.

The Centre said that due to measure taken by it including recapitalisation, banks are now “positioned to step up their support to meet the lending needs of a growing economy.”

PSBs committed to the government to significantly step up the level of domestic credit growth from 9.1 per cent year-on-year at the end the second quarter of the current financial year, said an official statement.

“PSBs committed to step up MSME lending. Banks committed to further improve on the robust growth in credit and reducing trend in turnaround time for loan applications through growing use of fintech and technology as evidenced by the success of the 59 minutes loan portal, through which over 1.25 lakh MSMEs have been accorded in-principle approval,” said the statement. It said that banks agreed to work further on increasing use of advanced data analysis and where possible, Artificial Intelligence (AI) algorithms for better, faster and hassle-free credit decisions and monitoring of accounts.

The banks were advised to maintain the trend of improvement in performance, with a view to bringing them out of the Prompt Corrective Action (PCA) framework at the earliest.

Of the 21 state-owned banks, 11 are under the PCA framework, which imposes lending and other restrictions on weak lenders.

The banks were asked to ensure that the benefits extended under Pradhan Mantri Jan Dhan Yojana (overdraft facility and accidental insurance cover on RuPay cards) reach the common people, and ensure opening of accounts as per expanded focus from “every household to every adult.”

Big Push

During the meeting, RBI governor Shaktikanta Das underlined the importance of PSBs for the economy especially at the present juncture in helping meet goals.

The Centre said that due to measure taken by it including recapitalisation, banks are now “positioned to step up their support to meet the lending needs.”

India Inc has been complaining that the banks were reluctant in giving loans. It said that the reluctance has impacted the liquidity situation in the market.