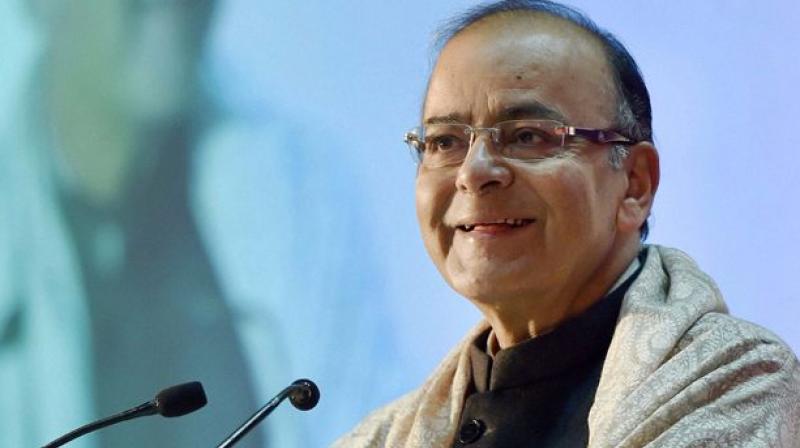

Digital payment fast replacing cash as predominant way: Jaitley

The finance minister also observed that technology has changed the entire dynamics the way the banking is done.

New Delhi: Finance Minister Arun Jaitley on Tuesday said digital transaction is fast taking the place of cash being a predominant instrument for transactions with a series of government initiatives to formalise the economy.

"We had almost reconciled to the fact that the economy would be substantially informal. It's only on its own strength that it will take decades or maybe, centuries to formalise itself and that no shake-up from the system was required.

"And that on its own pace would have taken an indefinite long time and we would have all waited till the cows came home for the economy to really formalise by itself. But then several policy initiatives that the government took one after the other have set off a chain reaction and that chain reaction is visible in various ways," he said here.

The finance minister, after launching the Paytm Payments Bank, also observed that technology has changed the entire dynamics the way the banking is done in the country.

"Earlier, we perceived banks to be brick and mortar branches. In fact, my fraternity in politics is still reasonably behind times. I still get representations during Parliament session from my colleagues who only insist on brick and mortar branches to be opened in their constituencies," he said.

Cash being the predominant instrument is gradually changing, he said.

"We all are realising that convenience, security and even proprietary lie in switchover itself," he said, adding that the conventional mind will find it extremely difficult to accept this, but then the whole mass below itself will change and only isolated cases will find themselves as an exception.

Paytm Payments Bank CEO Renu Satti said, "Paytm Payments Bank is the country's largest mobile-first, technology-led bank. By virtue of reaching every nook and corner of the country, we will be able to bring the large un-served and under-served population to the mainstream economy. We are committed to offering the most transparent, safe and trusted banking to masses."

Paytm on Tuesday officially launched its payments bank operations after a beta launch in May this year.

Accounts holders of Paytm Payments Bank will get benefits like zero-fee account -- no minimum balance required -- free IMPS, NEFT, RTGS, UPI transactions and access to over 1 lakh Paytm ATM locations across India.

Besides, the company has planned an investment of USD 500 million in KYC (Know Your Customer) operations. It is setting up KYC centres across India to complete the KYC process for customers and making them eligible for a Payments Bank account.

"Paytm Payments Bank is the country's largest mobile- first, technology-led bank. By virtue of reaching every nook and corner of the country, we will be able to bring the large un-served and under-served population to the mainstream economy," Satti added.