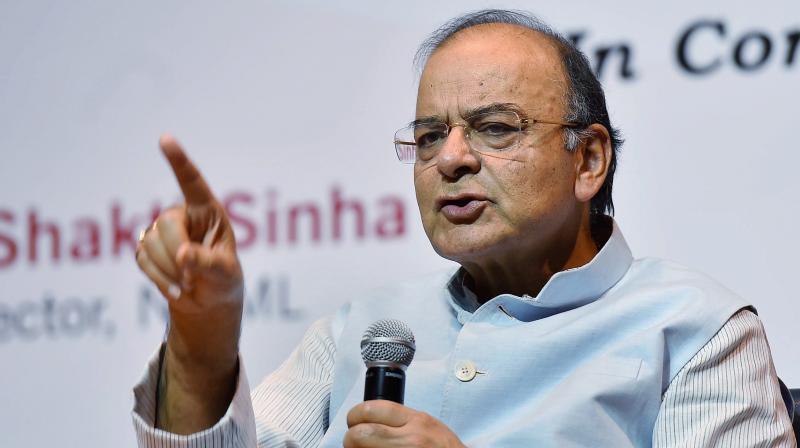

GST will transform tax system, make evasion difficult: Arun Jaitley

Finance Minister added that India will continue to remain the fastest growing economy and attain 7-8 per cent growth.

Mumbai: Days after the Union Cabinet gave its nod to draft model GST laws, finance minister Arun Jaitley said the biggest tax reform will streamline entire process of filing indirect taxes and will act as a deterrent for evasion.

“GST will transform complex indirect tax system to simple system and will make tax evasion difficult,” Jaitley said.

Finance Minister lauded Prime Minister Narendra Modi’s decision to ban notes and said, “Demonetisation will act as disincentive to continue with shadow economy, will integrate informal with formal economy.”

According to him implementation of the goods and services tax was biggest reform and government expected to put it into effect from July 1.

Jaitley who is holding additional charge of Defence Ministry added that the government was planning to slash corporate tax rate from 30 per cent to 25 per cent.

"Our aim is to bring direct tax rates at par with global standards," he added. According to him government sees a fiscal deficit target of 3.2 per cent for next fiscal 2017-18.

He believed 7-8 per cent economic growth was natural for country and a 4-5 per cent growth was expected in agriculture. "India will continue to remain the fastest growing economy and attaining 7-8 per cent growth is reasonably plausible," he said.

The Union Cabinet at its last meeting approved supporting GST laws that are Central GST, Integrated GST, Union Territory GST and Compensation to States GST.

After getting the Cabinet nod, the finance minister now plans to introduce these bills in the ongoing Budget session of Parliament. The government plans to table these bills as Money Bill as it does not necessarily require approval from Rajya Sabha.