Panel discusses GST rate; reaches consensus on compensation

The lower rates would be levied on essential items and the highest for luxury and demerit goods.

New Delhi: The GST Council on October 18 discussed possible Goods and Service Tax rates, including a four-slab structure of 6, 12, 18 and 26 per cent with lower rates for essential items and highest band for luxury goods, even as it reached consensus on payment of compensation to states.

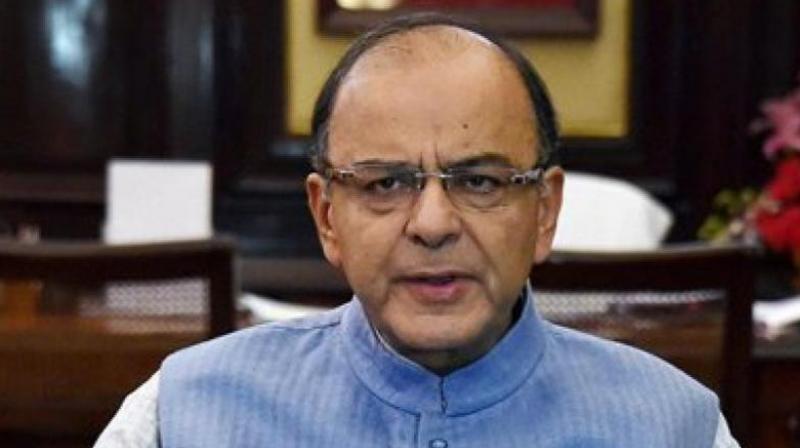

The all-powerful panel, headed by Finance Minister Arun Jaitley and includes representatives of all states, reached a consensus on the way states would be compensated for any loss of revenue from implementation of the new indirect tax regime from April 1, 2017.

Base year for calculating the revenue of a state would be 2015-16 and secular growth rate of 14 per cent would be taken for calculating the likely revenue of each state in the first five years of implementation of GST, Jaitley told reporters here. States getting lower revenue than this would be compensated by the Centre.

The GST Council on the first day of its three-day meeting discussed five alternatives of GST rate structure, he said, adding no decision was taken and discussions would continue tomorrow.

A four-slab structure of 6, 12, 18 and 26 per cent with a cess on the highest band for ultra luxury and demerit items like tobacco being levied was discussed. Food items are proposed to be exempt from the tax and 50 per cent of the items of common usage will be exempt to keep the inflation under check.

The lower rates would be levied on essential items and the highest for luxury and demerit goods.

The cess would help create a compensation fund to help compensate states for any loss of revenue from implementation of the new indirect tax regime that will subsume a host of central and state taxes including excise duty, service tax and VAT.

Kerala Finance Minister Thomas Issac said his state government wanted the highest rate to be fixed at 30 per cent so that common man items can either be exempt or levied with lower tax rates.

The compensation to states would be "limited to taxes subsumed into GST," he said.

The GST Council is likely to arrive at the final rate structure tomorrow and on the next day would discuss who will tax the 11 lakh service tax assessees.

"The principles of fixing the rate would be; it should be inflation neutral, states and centre continue with their expenditure and tax payers are not burdened," Jaitley said.

Once the rate structure is finalised, the technical group of state and central tax officers will discuss which item would fall in which tax bracket.

"So far between the last two meetings and today, we have been one by one reaching a consensus on each issue and so far all decision have been taken by a consensus. And the object is to keep on discussing and re-discussing even when there are no agreement on the first instance and take as many decision possible by consensus and to the extent possible avoid a situation where we have to put an issue to vote. So far we have achieved that objective," he said.

Explaining the rate structure proposed by the Centre, Revenue Secretary Hasmukh Adhia said that the lower rate is proposed at 6 per cent, standard rates at 12 per cent and 18 per cent and a higher rate of 26 per cent. Demerit goods such as tobacco, cigarettes, aerated drinks, luxury car and polluting items would attract cess over and above the 26 per cent rate.

Adhia said taxation of services would however be only in the 6 per cent, 12 per cent and 18 per cent with the higher rate at 18 per cent.

The rate of cess would be different for different items, Adhia said, adding that the amount collected from cess would go into a separate Rs 50,000 crore pool which would be used to compensate the states for revenue loss.

He said less than 10 per cent of the taxable goods would fall in the 6 per cent bracket. 70 per cent of the taxable base would come in 6, 12, 18 per cent tax bracket, while 25 per cent of the tax base will come into the 26 per cent category.

FMCG and consumer durable products would attract 26 per cent GST rate, against the current incidence of around 31 per cent.