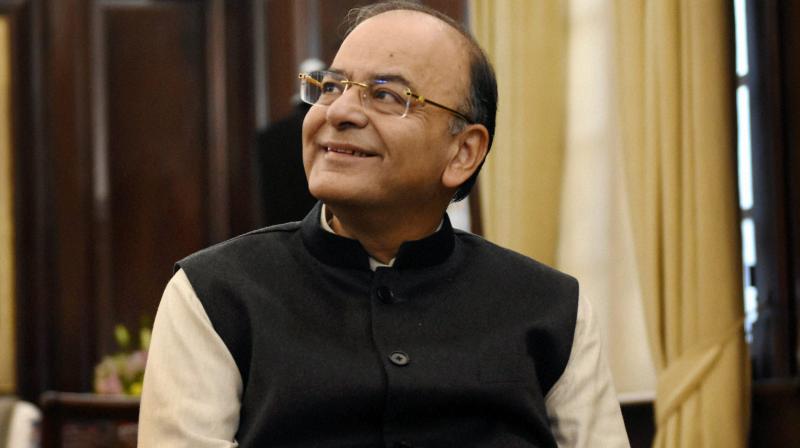

Lower tax possible, says Arun Jaitley

New Delhi: Union finance minister Arun Jaitley on Tuesday hinted at lower direct and indirect tax rates as demonetisation results in higher tax revenues from unaccounted wealth coming into system.

“So much money... operating as loose cash in the system has today come into the banking system,” he said. “It has to be accounted for. Where taxes have not been paid will now be recovered.

“The future taxation level would be much higher than what is currently being collected. This would also enable the government at some stage to make taxes more reasonable which will apply to both direct and indirect taxes,” the finance minister said.

Mr Jaitley said that the banking system will have lot more cash in it and therefore, “it’s ability to support economy with low cost cash, that is cash whose capital is much lesser, would be much higher.

“Obviously with all these advantages, the social cost also on the system will go down. “Therefore, the cash used for bribery, for counterfeit currency, for terrorism, for evading taxes itself will go down.”

He said that when this is seen along with many other reforms government is bringing about “particularly the proposed GST, the restrictions on cash spending subjected to PAN declaration, it itself is going to bring down the levels of corruption in society, it is going to bring down cash transaction in society and it’s going to bring down levels of evasion as far as taxation is concerned.”

Mr Jaitley said the drive, currently on, is at a stage where high denomination has ceased to be a legal tender. “It is actually a step in the direction of less cash economy. It’s our strategy that from high cash dominated economy we should become a less cash economy where the amount of paper currency comes down. Cash will still exist and there would be a greater digitisation,” he said