GST to be reality from July 1; Council clears crucial CGST, IGST laws

Mumbai: The all-powerful GST Council at its eleventh meet today cleared crucial Central GST and Integrated GST laws — two of the four supporting legislations that will now be tabled in Parliament.

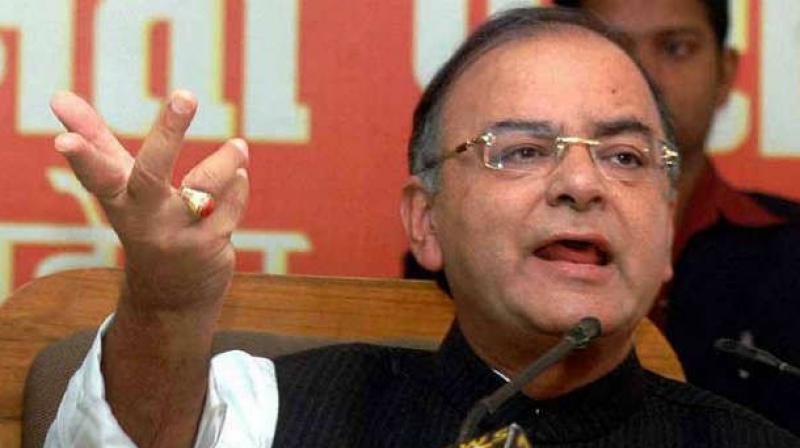

According to ET Now, Council headed by Finance Minister Arun Jaitley told states that the government has accepted all 26 points related to pan-India taxation raised by them.

The government is now poised to implement GST from July 1 provided it got necessary approval from Parliament, he said. "CGST, IGST and UT-GST law to be taken to Parliament in second half of Budget session starting March 9," he said.

The Council has agreed to empower state tax officers on par with their central counterparts. Besides, the finance minister has reportedly accepted cross empowerment of states, a demand raised by them earlier.

Hotels with an annual turnover of less than Rs 50 lakh will pay at the lowest tax slab of 5 per cent incorporated under the new indirect tax regime. The Council is meeting again on March 16 to further take up pending issues.

The issue of assigning tax slabs for different categories of goods and services would be taken up for redressal after March 15. The GST Council has fixed a four-tier tax system under GST.

Lower 5 per cent, two middle range tax slabs of 12 and 18 per cent and one peak tax rate of 28 per cent were included for GST implementation across the country.

However, the Council on March 2 said that it would insert an enabling provision in GST draft bill before tabling it in Parliament for a peak tax rate of 40 per cent.

This would make things easier as the Council will not have to approach parliament again in case it wanted to increase peak rate in future.