Cut in corporate tax to boost MSMEs growth: top officials

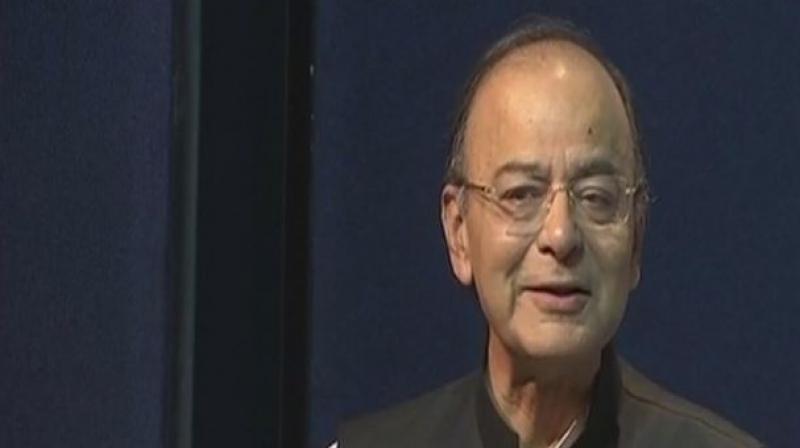

On Thursday, Arun Jaitley proposed to lower corporate tax rate to 25 pc for businesses with turnover up to Rs 250 cr.

New Delhi: Announcements made in the Budget for micro, small and medium enterprises (MSMEs) such as cut in corporate tax will help boost growth of this important sector, according to top company officials in this segment.

On Thursday, Finance Minister Arun Jaitley proposed to lower corporate tax rate to 25 per cent for businesses with turnover up to Rs 250 crore.

Retail engagement platform Netree CEO Desi Valli said the move will invite many smaller players to join the formal sector and bring transparency.

Startup online marketplace for auto component boodmo too said the government is giving special attention and treatment to MSMEs.

US based motorcycle firm UM Global Director Jose Villegas said the cut in tax rate will give cash surplus to MSME auto companies.

Sharing similar views, Ampere Electric Vehicle CEO Hemalatha Annamalai said that simplifications in indirect taxes will ease compliance requirements for the sector.

"The renewed thrust to MSMEs in the form of capital support and interest subsidy will surely help meet the credit demands of many companies," Annamalai said in a statement.

According to IT firm Aurelius CEO Sumit Peer said that MSMEs are critical players of economy and the tax reduction to 25 per cent from 30 per cent will be a great relief.

Adomantra Digital CEO Vikas Katoch stated that the Government’s decision introduce broadband services on more railway stations will invigorate the entertainment and digital advertising industry.