Union Budget 2018: Relief for salaried employees, standard deduction back of Rs 40k

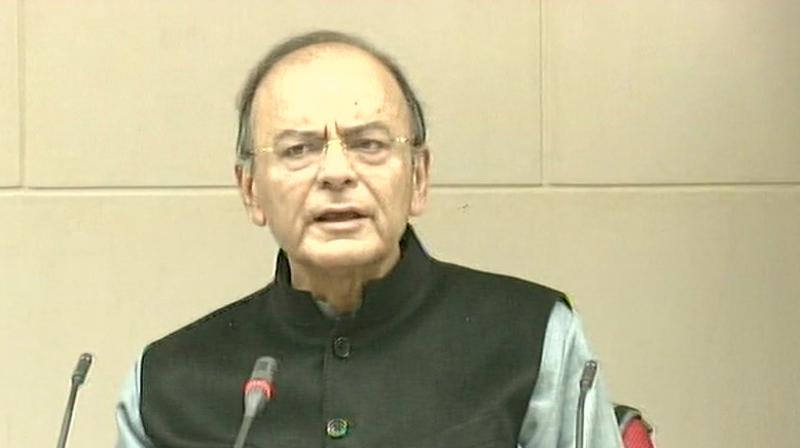

There were hopes ahead of Budget that Finance Minister Arun Jaitley would make the middle class happy.

Mumbai: Finance Minister Arun Jaitley made the middle class slightly happy in Union Budget 2018 by bringing back standard reduction of Rs 40,000 for the salaried employee in lieu of of transport allowance and medical reimbursement.

Stating the standard deduction would benefit 2.5 crore people, Jaitley said there would be no further changes to personal tax slabs. He said this would cost the exchequer Rs 8,000 crore.

The Finance Minister also announced that senior citizens can claim Rs 50,000 for general medical expenditure.

The minister, however, did not propose any change in the tax slabs or rates for individual taxpayers while presenting Union Budget 2018 on Thursday.

The standard deduction, which is provided to the salaried, was discontinued from the assessment year 2006-07.

Experts said this was a nominal benefit to the salaried class.

"Standard deduction of Rs 40,000 a year for salaried individuals seems to be a very nominal benefit as the current tax-free limit for medical expense reimbursement of 15,000 per annum and transport allowance exemption of Rs 1,600 per month is anyway leading to a total tax-free salary of Rs 34,200 per year," Alok Agrawal, Senior Director, Deloitte India said.

The finance minister said the government had made many positive changes in the personal income-tax rate applicable to individuals in the last three years.

"Therefore, I do not propose to make any further change in the structure of the income tax rates for individuals," he said.

Jaitley also noted that there is a general perception in the society that individual business persons have better income as compared to the salaried class.

However, income tax data analysis suggests that major portion of personal income-tax collection comes from the salaried class, he observed.

According to Jaitley, for assessment year 2016-17, 1.89 crore salaried individuals have filed their returns and have paid total tax of Rs 1.44 lakh crore which works out to average tax payment of Rs 76,306 per individual salaried taxpayer.

As against this, he said that 1.88 crore individual business taxpayers including professionals, who filed their returns for the same assessment year, paid total tax of Rs 48,000 crore which works out to an average tax payment of Rs 25,753 every individual business taxpayer.

Jaitley said apart from reducing paper work and compliance, this will help middle class employees even more in terms of reduction in their tax liability.

Also read: Union Budget 2018: Key highlights

Last year, the finance minister had given a rebate of Rs 2,500 for taxable salary up to Rs 3.5 lakh. Thee are expectations the minister might bring back the standard deduction, which is a flat deduction from income of a salaried individual.

At the moment, there is no tax for those earning Rs 2.5 lakhs, 20 per cent for those in the bracket of Rs 5 lakh to Rs 10 lakh, and 30 per cent for Rs 10 lakh and above salary.

For the senior citizen, up to 60 years, there is no tax till Rs 3 lakh, 20 per cent on income between Rs 3 to Rs 5 lakh, and 30 per cent for Rs 10 lakh and above.

For the ‘super senior citizen – aged above 80 years, the tax slabs are – nil up to Rs 5 lakhs, 20 per cent for Rs 5 lakh to Rs 10 lakh, and 30 per cent above Rs 10 lakh.

The salaried employee also saves under the following heads:

Section 80C: Section 80C of the Income Tax Act provides for an individual to get benefits of up to Rs 1.5 lakh with investments in provident funds, tax-saving mutual funds, National Savings Certificate, Sukanya Samriddhi Account etc. Tuition fees to two children also save money under this category.

Section 80CCD: It provides deduction up to Rs 50,000 for investment in an NPS Tier 1 account. This deduction is additional to the deduction available in Section 80C.

There are also exemptions on house rent allowance, on interest on housing loan, Section 80D, 80E and 80EE etc.

With agency inputs.