RBI Mulls Norms to Curb Insurance Mis-selling

Deputy Governor warns banks, NBFCs over insurance mis-selling and microfinance excesses

Mumbai: The Reserve Bank of India (RBI) is concerned over the rise of mis-selling of insurance products by banks and non-banking finance companies (NBFCs) and is examining whether to come up with guidelines to arrest such practices.

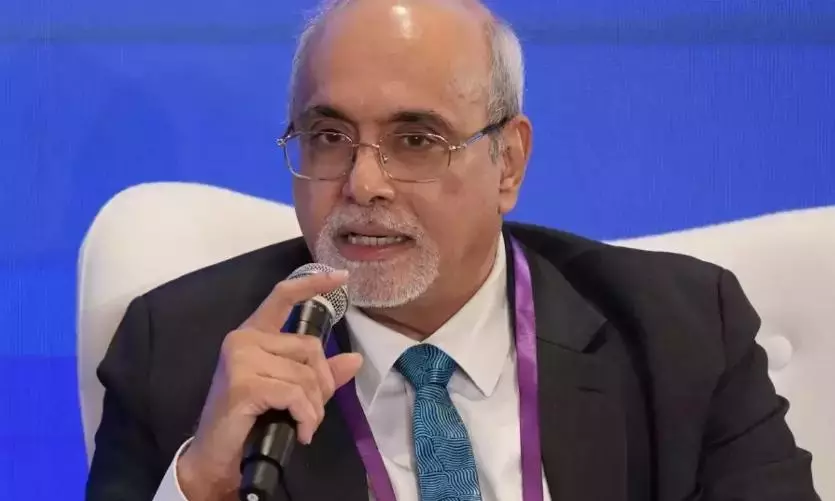

RBI Deputy Governor M Rajeshwar Rao said that while financial inclusion entails a bouquet of financial services, pushing the same indiscriminately to unaware consumers may be detrimental to their well-being and undermine its stated intent.

Speaking at a recent HSBC event on Financial Inclusion, Rao said, “There are reports of mis-selling of financial services such as insurance products. The concern is that such mis-selling without regard to suitability and appropriateness would beget distrust in schemes aimed at providing a safety net to the low-income households by creating artificial boundaries.”

“We are examining whether it necessitates framing of guidelines to address mis-selling of financial products and services by REs (regulated entities/Banks).”

He also said that the rising incidents of frauds through novel techniques makes it imperative that regulated entities collaborate with other stakeholders like self-regulatory organisations, NGOs, etc. to generate awareness and promote safe digital practices among customers.

Rao also warned that microfinance continues to grapple with high interest rates, rising over-indebtedness, and harsh recovery practices, highlighting the need for urgent reforms.

While microfinance has played an important role in financial inclusion, some issues need attention, he said.

"The sector continues to suffer from the vicious cycle of over-indebtedness, high interest rates and harsh recovery practices.

While some moderation in interest rates charged on microfinance loans has been observed in recent quarters, pockets of high interest rates and elevated margins continue to persist," he added.

Even lenders with access to low-cost funds have been found to be charging margins significantly higher than the rest of the industry and in several instances, appear to be excessive, Rao said.

Lenders should look beyond the conventional "high-yielding business" tag for the sector and approach it with an empathic and developmental perspective, recognising the socio-economic role that microfinance plays in empowering vulnerable communities, the deputy governor said.