RBI Delivers Dovish Pause

After a detailed assessment of the evolving macroeconomic outlook, the committee voted unanimously to maintain the repo rate at 5.5 per cent

Mumbai: The Reserve Bank of India's (RBI) rate setting panel on Wednesday left the repo rate (at 5.50 per cent) and policy stance unchanged at neutral for the second consecutive review meeting choosing to buy time and let the earlier 100 basis points of easing fully percolate through the financial system even as the growth picture brightened. One basis point is one hundredth of a percentage point.

The repo rate is the rate at which the RBI lends short term money to commercial banks. When the repo rate rises, borrowing becomes costlier for banks, leading to higher lending rates for consumers. When the repo rate falls, banks get access to cheaper funds and in turn reduce interest rates for individuals and companies. For homebuyers no change in repo rate means no immediate change in home loan EMIs.

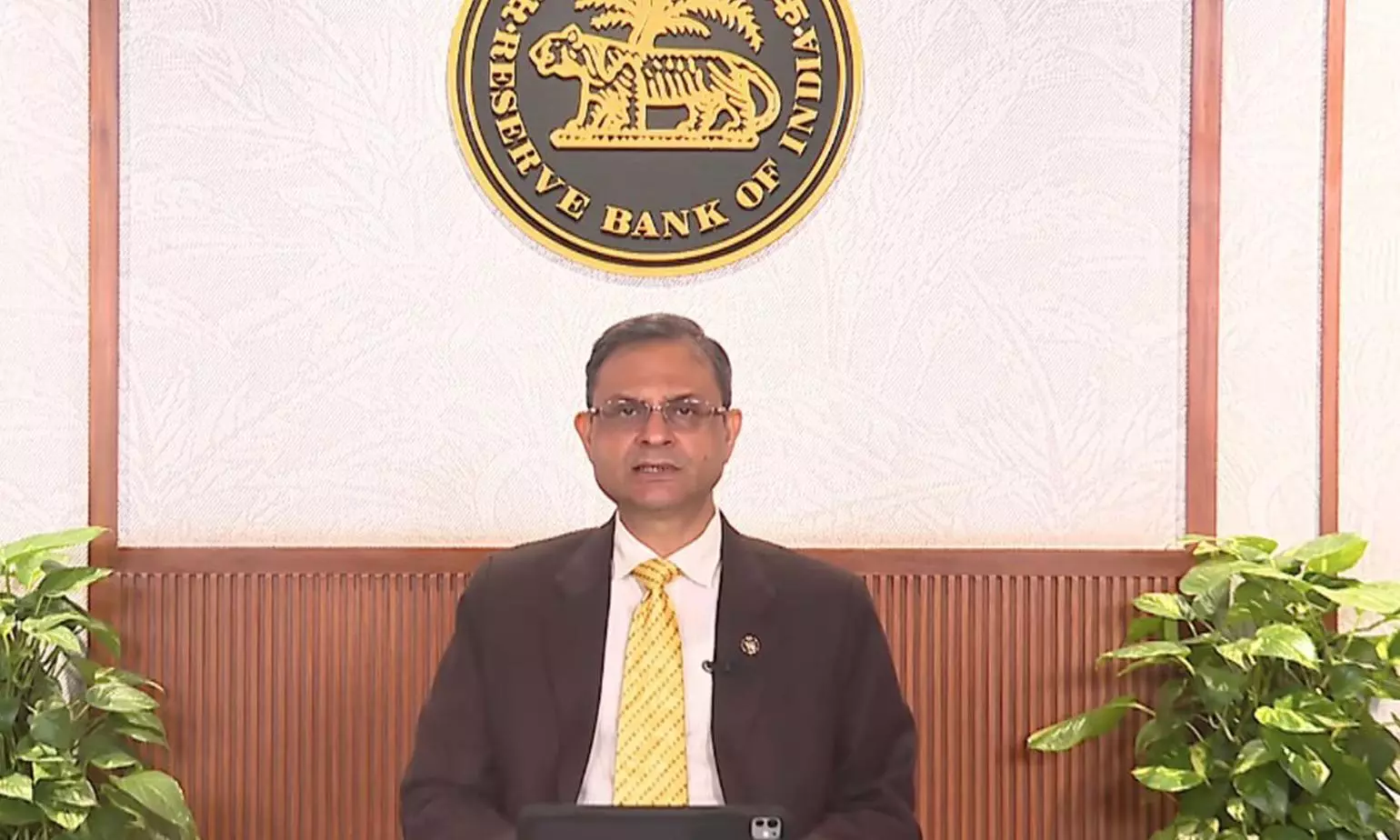

The RBI lifted its FY26 growth projection to 6.8 per cent from 6.5 per cent earlier. On inflation, the Monetary Policy Committee (MPC) was noticeably more sanguine, trimming its FY26 CPI forecast to 2.6 per cent from 3.1 per cent. The RBI Governor Sanjay Malhotra signaled that there is room to lower rates if inflation stays below expectations and growth conditions remain favourable. Speaking at the post policy press conference, he stated that the recent Goods and Service Tax (GST) rationalisation will not completely offset the impact of the 50 per cent tariffs imposed by the US on Indian exports.

"The MPC concluded that there has been a significant moderation in inflation. Moreover, the prevailing global uncertainties and tariff related developments are likely to decelerate growth in H2:2025-26 and beyond. The current macroeconomic conditions and the outlook has opened up policy space for further supporting growth. However, the MPC noted that the impact of the front-loaded monetary policy actions and the recent fiscal measures is still playing out. The trade related uncertainties are also unfolding. The MPC, therefore, considered it prudent to wait for the impact of policy actions to play out and greater clarity to emerge before charting the next course of action.

Accordingly, the MPC unanimously voted to keep the policy repo rate unchanged at 5.5 per cent and decided to retain the stance at neutral,” said Malhotra in his statement.

In its previous meeting held in the first week of August, the RBI had kept the repo rate unchanged and kept its stance on the monetary policy as neutral. The MPC had cut rates by 100 basis points in its February, April, and June 2025 policy bringing the repo rate down from 6.5 percent. Economists now expect the RBI to cut rates in December policy.

The Governor also announced a package of 22 additional measures aimed at strengthening the resilience and competitiveness of the banking sector, improving the flow of credit, promoting ease of doing business, simplifying foreign exchange management, enhancing consumer satisfaction, and internationalisation of Indian Rupee.

The RBI governor also clarified that there are currently no proposals to levy charges on UPI transactions.