No quick fixes for economy, says Subbarao

Former RBI governor says economy is doing well, but India must address joblessness, and income inequality

Hyderabad: Former Reserve Bank of India governor Duvvuri Subbarao is one of the illustrious officials in India, who has vast experience in running the country as well as the economy. An IITian and IAS, he is adept in fire fighting and held several key posts in his long career. He is one of the few officials who headed the Union finance ministry as well as the Reserve Bank of India. He has experience on either aisle of the country’s financial superstructure — the fiscal and the monetary sides.

In a free-wheeling interview with Deccan Chronicle, Subbarao spoke about the status of the Indian economy, its weaknesses, joblessness, welfare schemes, and also immediate issues that the country’s policymakers should focus their attention on to make people prosper.

Excerpts:

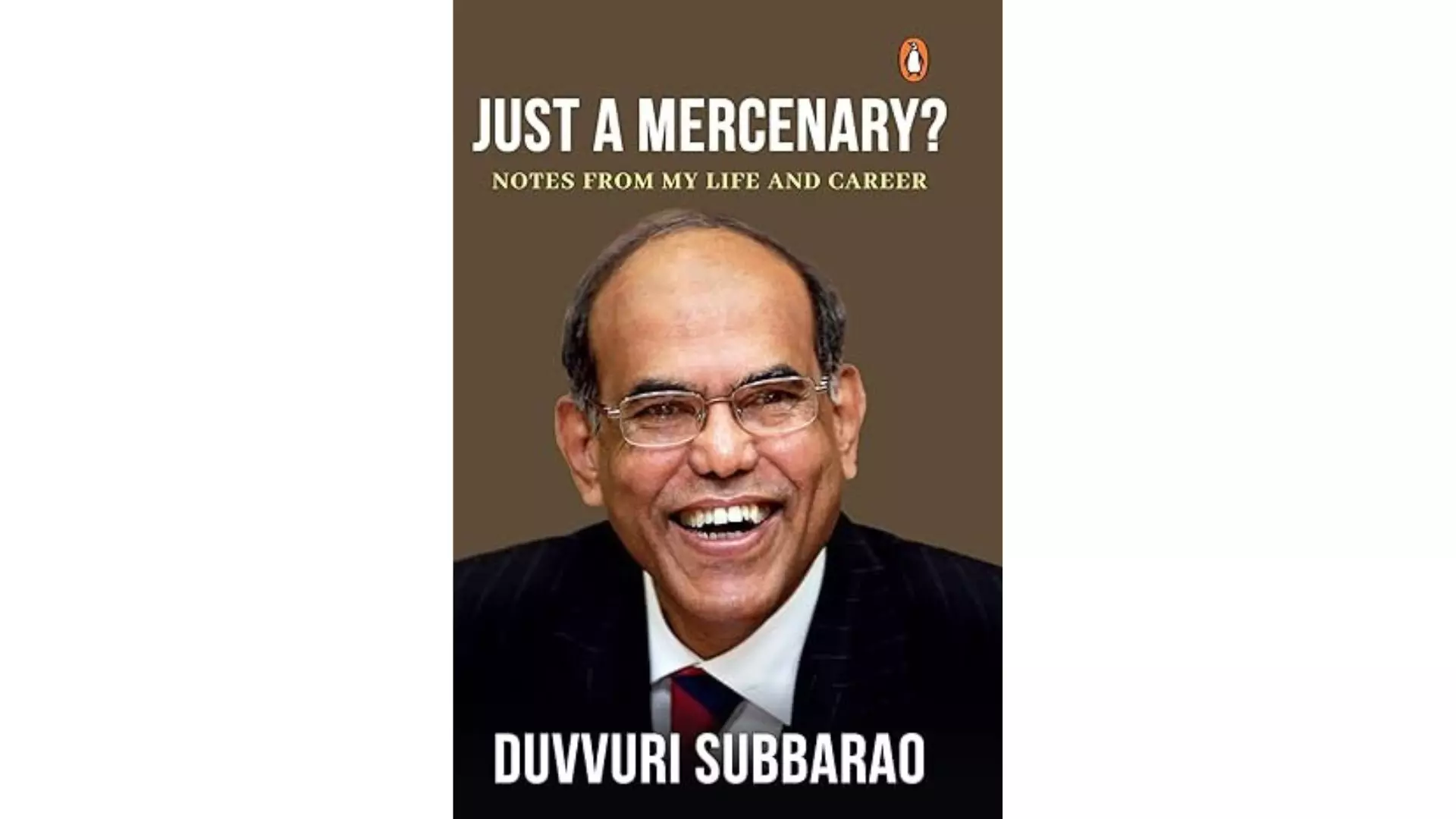

What made you opt for the title ‘Just a Mercenary’ for your book? Why did you think that you could be just a mercenary?

I considered a few other titles for the book. Eventually zeroed in on this title. The reasons are the following:

That all of us are prone to complaining about our country. About how it is unequal, unjust. There are no opportunities for merit… But when I look back on my career and my life, I find that this country has given me so much. I went to Sainik School with a government scholarship. I went to an IIT, again with a scholarship. I got the opportunity to serve in the IAS. At the end of my career, I was privileged to become the governor of the Reserve Bank of India.

These opportunities came my way, and I have got a lot from society. The question that has always run in my mind was, for all that I have got from society, have I given back enough? Of course, every job, every assignment I had, I tried to do my best. But what was the motivation for me? Was it just doing your best because you are being paid a salary? Or was I motivated by a larger purpose? In short, was I just a mercenary, or was I more? And that is why I left it with a question mark, for readers to make their own inference about what I was.

What is your assessment of the Indian economy?

That is a very broad question. But the economy is doing well, growing at 8 plus per cent year before last, 7.6 per cent last year, and around seven per cent this year. The economy may grow probably around 6.5 per cent for the next two to three years.

So the economy is doing well. Inflation is coming under control. The rupee is stable. So, in one sense, the economy is doing well. But the question is, can we maintain the momentum?

Economic growth, as you know, comes from consumption, and investment. Government expenditure, and net exports.

At the moment, however, the entire economic growth is coming largely from public investment. From government expenditure on infrastructure, which is very good.

But because of its own fiscal compulsions, the government cannot continue this level of public expenditure. Other growth drivers have to come into play, particularly private investment and private consumption.

Because all said and done, private consumption is our biggest growth driver. About 500 million people, who are middle class or low middle class, make up the bulk of our consumption. If their incomes go up, they will spend more. That spending is for production. That production is for jobs. Those jobs will generate more income and more growth. We can get on to a virtuous cycle. So we need to ensure that not only do we grow rapidly, but the benefits of growth are widely shared.

So first as I said, we need to ensure that private investment gets consumption, which requires prosperity being widely shared.

In one of your previous interviews, you called for the distribution of wealth among the wider section of society. What do you mean by that? How should we share it?

I don't mean taking away from the rich and giving it to the poor. That's not the way it is done. We must provide opportunities to the poor. Increase job opportunities so that they can earn. That's the only way to do it.

So what is stopping the private industry from investing, which could create jobs for people?

For about 10 years, we had this twin balance sheet problem. As NPAs were high, both balance sheets of the banks and corporates were hit. But they have been repaired. Now banks are in good shape. Corporates are in good enough shape to invest.

However, private investment has declined after hitting the peak in 2007. It's gradually picking up, but it's still far below our investment level. Capacity utilisation is getting to the saturation level. Private investors think of fresh investment when capacity utilisation gets to over 80 per cent. And we're close to that.

So now is the time for private investment to come in. And I believe that they're waiting for the elections to be over and private investment should come in, especially on the back of all the public investment that the government has done.

Experts notice two jarring notes in industry trends. Income growth of the companies is largely coming from premium products, which affluent class buys, and a rapid increase in personal indebtedness. So does the large section of people from the middle class and the poor have money to spend?

That is true. There is income inequality. So we must first solve the income inequality problem. Like you said, much of the consumption today is coming from the upper income segments because low income segments are constrained, (their budgets) are very tight.

They are, in fact, hitting the limits of their borrowing. They cannot continue like this. That is why I said we must create opportunities for the low income segments to improve their incomes because their marginal propensity to consume is high.

If the income of the top 20 per cent goes up, they will spend on luxury items or they will import. That will not help domestic production. It is when the bottom 400 to 500 million see higher income, they will spend that and that is our growth driver and that is what we must focus on.

So how can it be done?

We must create jobs for people because unemployment is by far one of the biggest problems in the economy today. Numbers are disputed. We don't have reliable numbers of unemployment.

People say unemployment is 7 or 8 per cent. Number of jobs to be created, I've seen estimates, from 50 million to 120 million. You can dispute the numbers but you cannot deny that the problem is big.

In fact, within the agriculture sector itself, there are about 50 million people who are underemployed. They're shown as employed but they're underemployed. In fact, if the agricultural productivity goes up as we want it to, the agriculture sector will throw out those 50 million people who have to find jobs elsewhere.

Similarly, jobs are not going to come from the services sector.

When we talk of services, we think of high-tech software in Bengaluru, Hyderabad, Pune and Noida. But the software industry has created after all within itself about seven million jobs. For a labour force that is one billion, seven million is nothing at all.

So jobs have to come from the manufacturing sector. We need a large manufacturing sector, which is not very job intensive. But hopefully, there will be vertical integration taking place. Those large industries will generate demand for medium and small industries which are job intensive, which will generate demand for low-level enterprises at the informal level which will generate even more jobs. We need all that. To do that we need to improve education. We need to improve our skills. This is a long haul but we've got to start that now.

So there is no quick fix for this?

I don't think there is a quick fix. The government is doing Mudra loans, trying to encourage entrepreneurship, start-ups and all that and they are generating employment. But the bulk of our unemployment problem is of people who are unskilled or semi-skilled. Yet we've got to create jobs for them.

When we speak of agriculture, there is a lot of mechanisation happening there. And some people also complain that they are going for mechanisation because of shortage of labour.

Shortage of labour at a competitive price. Labour productivity is low. So they go for machinery because productivity of machines and capital is higher than the productivity of labour. So the solution is to improve labour productivity, skills, and education..

But by the time these people get skilled, will India still have the demographic dividend?

That is another question. It is estimated that India will have the demographic dividend until the next 25 years. But we may not even have 25 years because there is a huge problem.

First of all, I want to say that income levels have gone up across the board. It is not as if the rich have gotten richer and the poor have gotten poorer. The rich have gotten richer, the poor have gotten better also, but not as much. But the gap has increased widely. So we need to ensure that this gap is bridged.

This brings me to the question of welfare schemes or sops. As an economist, do you think there should be any limit to the government’s welfare expenditure? If yes, what would be that?

I can't define the limit offhand like this. But we are seeing in this election season, all major political parties are promising handouts. I agree that in a poor society like ours, it is mandatory for the government to support and provide safety nets to the most vulnerable. But that's got to be within limits, especially because these, what we call handouts, are being financed by borrowing.

We know from economics that the loan has to repay itself by generating a future income stream. Otherwise, it becomes a burden. That will not be the case if we just borrow and spend on handouts, because these handouts are being used for current consumption. They're not generating revenue for the government in the future which could be used to repay the loan.

On the other hand, if the government spends on physical infrastructure or social infrastructure like education and health, it will generate growth. That growth will generate tax revenue, and that tax revenue will aid the government to repay the loan. So that is the theory.

There is also a counter-argument that presumes that these handouts are used, for example, to provide better education to children, or to provide better nutrition which will build a healthier society.

That is true. I agree that if you increase their incomes, it is possible that they will spend a part of that on education and health of the children. But is that the way to do it, or if you want to improve education and health, focus on improving education and health rather than giving handouts to people. There are the most efficient and effective ways of doing this.

GDP is a factor of production. So, centuries ago, India was the largest economy in the world purely because we had more people. Now, the production and the labour have got divorced because of mechanisation and artificial intelligence. So, is GDP as a metric to measure welfare or prosperity of people still valid?

Well, that is another question that has been contested. That GDP does not measure welfare. It does not measure prosperity. It does not, for example, look at distribution. It looks at the aggregate number.

So, in our situation today, if the economy is growing at seven or 7.5 percent, we believe that the economy is doing well even when, like you said, the spending levels or affordability has not gone up across the board. So, GDP is an imperfect measure. But nobody has been able to come up with a better metric.

You have handled two biggest economic crises that the Indian economy has faced in your career. What lesson India should take from those crises?

What lessons India must take is that in a globalised world, what happens anywhere in the world affects us. So, globalisation has been a force for good.

It has improved incomes, improved jobs, not just in India but around the world. We benefited from that. But it also imposes ruthless costs. For example, we saw during the Global Financial Crisis and the Taper Tantrums crisis were all costs of globalisation.

The lesson that we must draw from these crises is that the solution is not to withdraw from globalisation. But the solution is to be able to better manage globalisation by trying to minimise the costs and maximise the benefits.

During your term as the RBI governor, you were confronted mostly with supply-side inflation. Can RBI control supply-side inflation?

That has been a question in textbook economics and we are experiencing it in our economy now. One of the arguments against inflation targeting was that in India, inflation is triggered more often by supply shocks than by demand pressures. The instrument available to the central bank, i.e. the Reserve Bank of India, is called monetary policy, which acts by curbing demand. So is monetary policy an appropriate instrument for inflation, which is driven by supply shocks because monetary policy is acting on the demand side, whereas the problem is from the supply side?

That's been the argument. The traditional response of the RBI, which I gave and which the governors today also gave, is that it is true that monetary policy is most effective in curbing inflation when it is driven by demand shocks. However, even if inflation is driven by supply shocks, if inflation persists for a long time, inflation expectations get de-anchored and inflation can get generalised.

So there is a case for monetary policy action even if inflation is driven by supply shocks. That's been the standard response. So two things I am saying.

Monetary policy is less effective in controlling inflation if it is driven by supply shocks. But even in such a situation, monetary policy has a role to play. But much of the government on its part has a bigger role to play by improving supply management.

RBI is sitting on a mountain of forex reserves. When RBI buys dollars, won’t it increase more rupees in the system? Previously, India allowed individuals and companies to maintain dollar accounts. Which is the right way?

See, it's got to be both ways. Of course, if the RBI is intervening in the market and buying dollars, it increases money supply. And RBI has an option of sterilising it, withdrawing that liquidity. We used to do it through MSF earlier. But now they can withdraw liquidity through raising the repo rate or by open market operations.

In 2014, cash with people was Rs 12 lakh crores. Now it's Rs 34 lakh crores.

Yes, currency in circulation goes up with the economy. From 2014 to 2024, the economy has expanded. So, currency in circulation goes up. But currency in circulation goes up also for other reasons. For example, RBI study shows that during election times, currency in circulation goes up.

If you think structurally currency in circulation has gone up, where does it come from? Why have money with banks come down? That's a question to ask. Is it that deposit rates are not attractive enough?

As people have a lot of cash, is interest rate transmission happening properly in India?

One of the things the central banks worry about is monetary policy transmission. Because the main instrument for monetary policy is the interest rate. And the interest rate that the central bank controls is the open-ended interest rate. The theory is that that single interest rate will influence the entire interest rate structure in the economy.

And that process by which the RBI's interest rate policy affects the interest rate structure in the economy is monetary policy transmission. That happens through the bond market. That happens through the money market.

That happens through the credit market. Monetary policy transmission is certainly improved over time. But we have not got to the best practice yet. The reasons for this constraint are administered interest rates and financial suppression.