Indians preferred face to face shopping over online this Diwali: Visa study

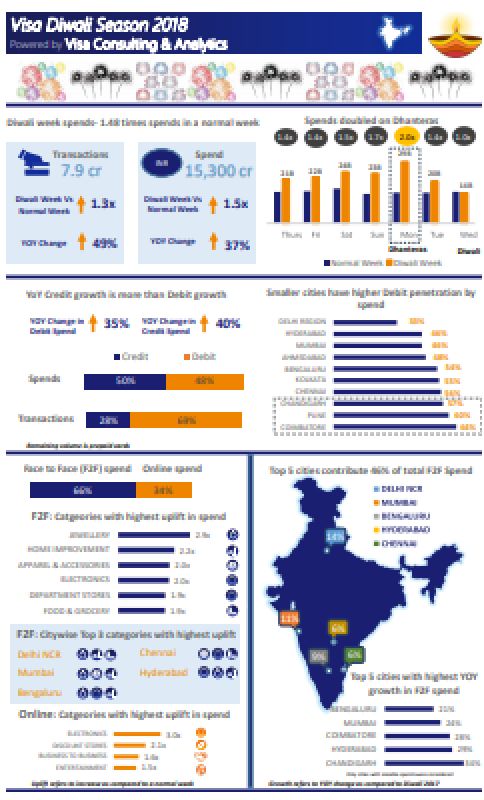

During the week leading to Diwali, Visa recorded 7.9 crore transactions, up 49 per cent from last year.

Mumbai: Visa today released data on consumer spending in India during the week leading to Diwali this year on Visa cards. The data captures consumer spending patterns via payment cards (debit and credit), both for face to face (F2F) and online shopping across cities and different shopping categories during the period.

“Our study has thrown up some very interesting and encouraging insights on consumer spending habits. While ecommerce continues to make strong inroads in India, for key occasions and festivities citizens still prefer a personalized experience, accompanied by ‘touch-and-feel’. In addition, the higher debit penetration by spend from the smaller cities, validates the healthy progress of the nation towards a less-cash society,” Group Country Manager, India & South Asia, Visa, TR Ramachandran, said.

During the week leading to Diwali, Visa recorded 7.9 crore transactions, up 49 per cent from last year, amounting to Rs 15,300 crores, up 37 per cent, year-on-year. While the average spend was 1.48 times more than that during a normal week, it doubled (to Rs 2,900 crores) on Dhanteras, which was on November 5, 2018. This could also be seen from a 2.9 times increase in the spend for Jewellery during the week, compared to a normal week.

Breaking down the spends via payment cards, there was a 40 per cent YoY increase in credit spend as against a 35 per cent YoY increase in debit spend. Of the total spends, credit contributed to 50% and debit to 48 per cent respectively this year.

While the top five cities of Delhi NCR, Mumbai, Bengaluru, Hyderabad and Chennai contributed 46 per cent of total F2F spend, the city of Chandigarh, with a 34 per cent change, recorded the highest growth in F2F spend. Chandigarh, along with other smaller cities like Coimbatore and Pune, showed increases of up to 64 per cent in debit spend. This reinforces the confidence that the citizens of India are adapting to digital payments, thereby reducing their dependence on cash.