Aramco lines up big plans for India

Meanwhile it is reported that the company is in talks with RIL to buy 25 per cent in Mukesh Ambani’s refining and petrochemical business.

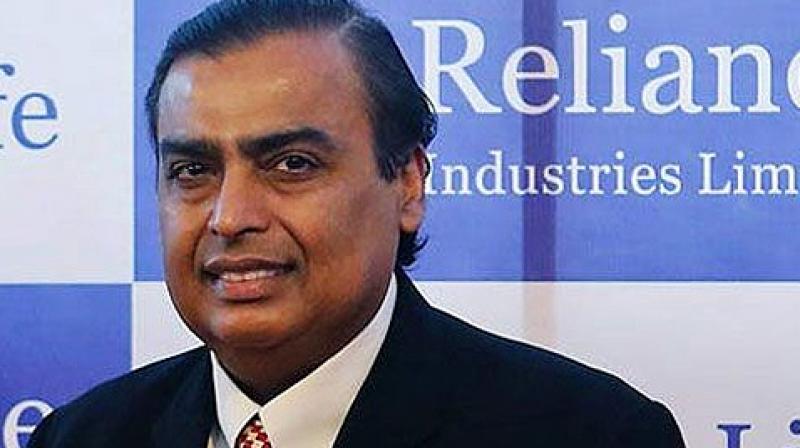

Mumbai: Saudi Aramco, the world’s most profitable company with a profit of $111 billion in 2018, is lining up huge investment plans in India including picking up a 25 per cent stake in refining and petrochemical business of Mukesh Ambani-owned Reliance Industries.

It had earlier announced a $44-billion investment to build India’s largest oil refinery on the country's west coast along with three domestic oil marketing companies -- Indian Oil, Bharat Petroleum and Hindustan Petroleum.

The refinery will be among the world’s largest refining and petrochemicals projects will be able to process up to 1.2 million barrels of crude a day.

“Investing in India is a key part of our company’s global downstream strategy, and another milestone in our growing relationship with India,” Aramco President Amin Nasser had said after announcing the deal for the refinery.

“Participating in this mega project will allow Saudi Aramco to go beyond our crude oil supplier role to a fully integrated position that may help usher in other areas of collaboration, such as refining, marketing, and petrochemicals for India’s future energy demands,” he further said.

Meanwhile it is reported that the company is in talks with RIL to buy 25 per cent in Mukesh Ambani’s refining and petrochemical business.

Saudi Aramco, world’s largest oil exporter, is believed to have first shown interest in Reliance about four months ago but the talks gathered momentum after Saudi crown prince Mohammed bin Salman (MBS) visited India in February. He had then met RIL’s head Mukesh Ambani.

Meanwhile RIL said “as a policy, we do not comment on media speculation and rumours. Our company evaluates various opportunities on an ongoing basis.”

The report, quoting people with knowledge of the development, said that an agreement on valuation is likely by June this year. A minority stake sale in RIL could fetch around $10-15 billion, valuing RIL’s refining and petrochemicals businesses at around $55-60 billion.

Aramco is making huge investments across the globe and is expected to come out with a public issue of its shares which is slated to be the largest IPO globally. It recently came out with a $10 billion bond issue which was seen as a gauge of potential investor interest in the Saudi company's eventual public offering.