Quarter 3: Bad loan situation stabilising for banks

Wait for a quarter more to see if recognition cycle is over.

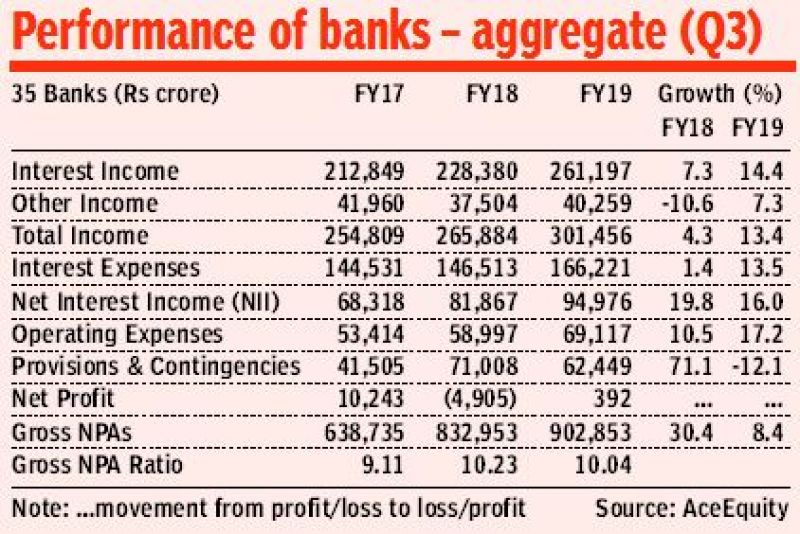

Mumbai: Even though profitability remains under pressure, the bad loan situation in the banking sector seems to be stabilising, going by the numbers posted by lenders for the third quarter ended December 31, 2018. However, analysts believe it is still not clear if all the legacy bad loans have been recognised by banks and they would rather wait for another quarter of moderation in growth of bad loans, which could indicate that the recognition cycle is over.

According to an analysis of 35 banks 18 public sector banks and 17 private sector banks--by Care Ratings, the non-performing assets (NPAs) of state-owned lenders were above thrice that of the private sector banks as of December 2018. The gross NPAs stood at Rs 9.03 lakh crore as of December 2018, of which Rs 7.75 lakh crore resided in public sector banks and Rs 1.28 lakh crore in private sector banks. The NPA ratio of public sector banks (PSBs) stood at 13.09 per cent while that of private banks stood at 4.16 per cent at the end of Q3 FY19.

On the profitability front, too, the state-owned lenders lagged behind. Barring the top public sector banks such as State Bank of India (net profit of Rs 3,955 crore during Q3FY19 as against net loss of Rs 2,416 crore in corresponding period last year), Bank of Baroda (321.6 percent year-on-year rise at Rs 471.21 crore) and Canara Bank, most other PSBs continued to report losses.

The PSBs continued to register huge losses with their losses still coming to Rs 11,109 crore in Q3 FY19 compared with Rs 16,067 crore in Q3 FY18.

In comparison, the net profit of private lenders rose by 3 per cent to Rs 11,501 crore in Q3FY19 vis-a-vis growth of over 12 per cent (Rs 11,162 crore) during corresponding period of the previous year.

The cumulative net profit of all banks stood at meagre Rs 392 crore during the third quarter.

A banking analyst said, “Most of the public sector banks have not reported incrementally higher slippages last quarter, which provides some comfort. Since public sector banks are undervalued, any improvement in their asset quality will be taken positively by investors. Earnings recovery could start happening from FY20 for PSU banks.”

Bad loans for banks increased at a lower rate of about 8.4 per cent in Q3 FY19 vis-a-vis a double-digit growth of 30.4 per cent in Q3 FY18, with the NPA ratio decreasing marginally to 10.04 per cent in Q3 FY19 from 10.23 per cent in Q3 FY18.