Institutional ownership at an all-time high: Morgan

Mumbai: The recent bull market rally on the domestic bourses have led to the equity ownership of both domestic as well as foreign institutional investors hitting an all time high during the April-June period.

According to data analysed by Morgan Stanley, the foreign portfolio investors (FPI) equity ownerships rose to 27.5 per cent as at the end of June 2017 surpassing the previous high of 27.3 per cent in September 2016. Their overall investment in Indian equities are now valued at $395 billion.

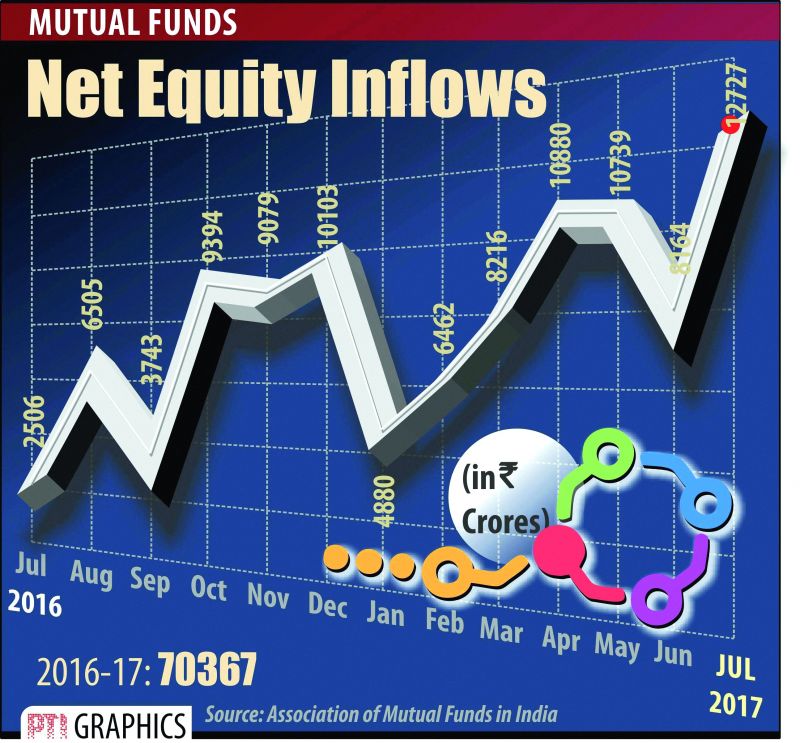

On the other hand, the domestic mutual funds have increased their equity holding for the 12th quarter running to 5.7 per cent, highest level since December 2001 while domestic financial institutions such as insurance firms and banks increased their stakes marginally to 7.6 per cent. The combined ownership of all three categories of institutional investors have risen to 40.7 per cent during the June ended quarter, highest level in history.

Overall, institutions remain more overweight in financial sector stocks while they are most underweight in healthcare and technology stocks.

Morgan Stanley pointed out that the FPIs are overweight in just two out of the ten MSCI sectors with financials in the lead position followed by utilities. Their biggest underweight positions are in healthcare, energy and materials.

Domestic mutual funds are overweight in four sectors with financials and consumer staples emerging as their most favourite picks while they are largely underweight in technology and energy stocks.

Similarly, other domestic institutional investors like insurance firms are overweight in four out of the ten sectors with the largest being consumer staples and utilities. Their biggest underweight positions are in technology followed by healthcare.

In 2017, overseas investors have pumped in Rs 56,131 crore into the equity market while mutual funds have invested Rs 54,598.94 crore during the same period on the back of persistent inflows into equity oriented schemes offered by fund houses. This has helped the domestic markets to scale record high despite high valuations.