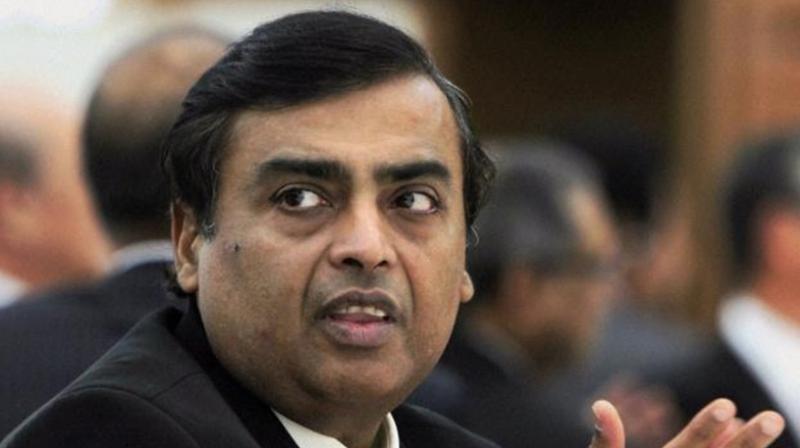

Mukesh Ambani leaves behind Chinese rich Hui Ka Yan

Globally, Mr Ambani stood at the 14th spot, while Mr Yan is ranked 18th on the list.

Hyderabad: Reliance Industries chairman Mukesh Ambani has overtaken Chinese billionaire and real estate baron Hui Ka Yan, acquiring the most coveted tag of Asia’s richest, said Forbes.

According to Forbes Realtime Billionaire Index, Mr Ambani was worth $42.1 billion on Tuesday compared to Hui Ka Yan’s $40.6 billion assets — a difference of $1.5 billion.

The Realtime Billionaire Index tracks the wealth of nearly 2,000 billionaires across the world.

Globally, Mr Ambani stood at the 14th spot, while Mr Yan is ranked 18th on the list. The index is updated daily at 5 pm EST (New York) on the last trading day.

According to Forbes, Mr Ambani’s personal has appreciated by $466 million, while Mr Yan’s assets fell by $1.2 billion or 2.8 per cent on Tuesday.

Mr Ambani appears to have benefitted from the steep fall in the shares of Mr Yan’s companies in the last couple of days.

The Chinese markets had seen a turbulent time on Monday and Tuesday. The stock price of Mr Yan’s Evergrande Group had plunged as his companies were under government scrutiny for its enormous debt from $11,445 a piece on Monday to $11,368 on Tuesday. The stock continued to trade weak on Wednesday as it ended at $11,349.3.

Mr Mukesh’s RIL, however, has been going strong on the bourses following robust growth in gross refining margins and petrochemical revenues.

Another Chinese billionaire and Alibaba.com foun-der Jack Ma stands at 20th spot with $40.1 billion in the Forbes billionaire index.

However, another billionaire index compiled by Bloomberg, a US-based news agency, tells a completely different story.

According to Bloomberg realtime Billionaire Index, Mr Ma tops Asia’s rich list with $47.3 billion wealth, followed by Mr Ambani ($40.5 billion) and Mr Yan ($40.1 billion).

The Bloomberg Index ranks Mr Ma as the 11th richest in the world. Mr Ambani and Mr Yan trail at 19 and 20 ranks.

The agency claims that the index reflects is a daily ranking of the world’s richest people. “The figures are updated at the close of every trading day in New York,” the agency claimed.