Budget 2025 Live: No tax on annual income of up to Rs 12 lakh under new regime

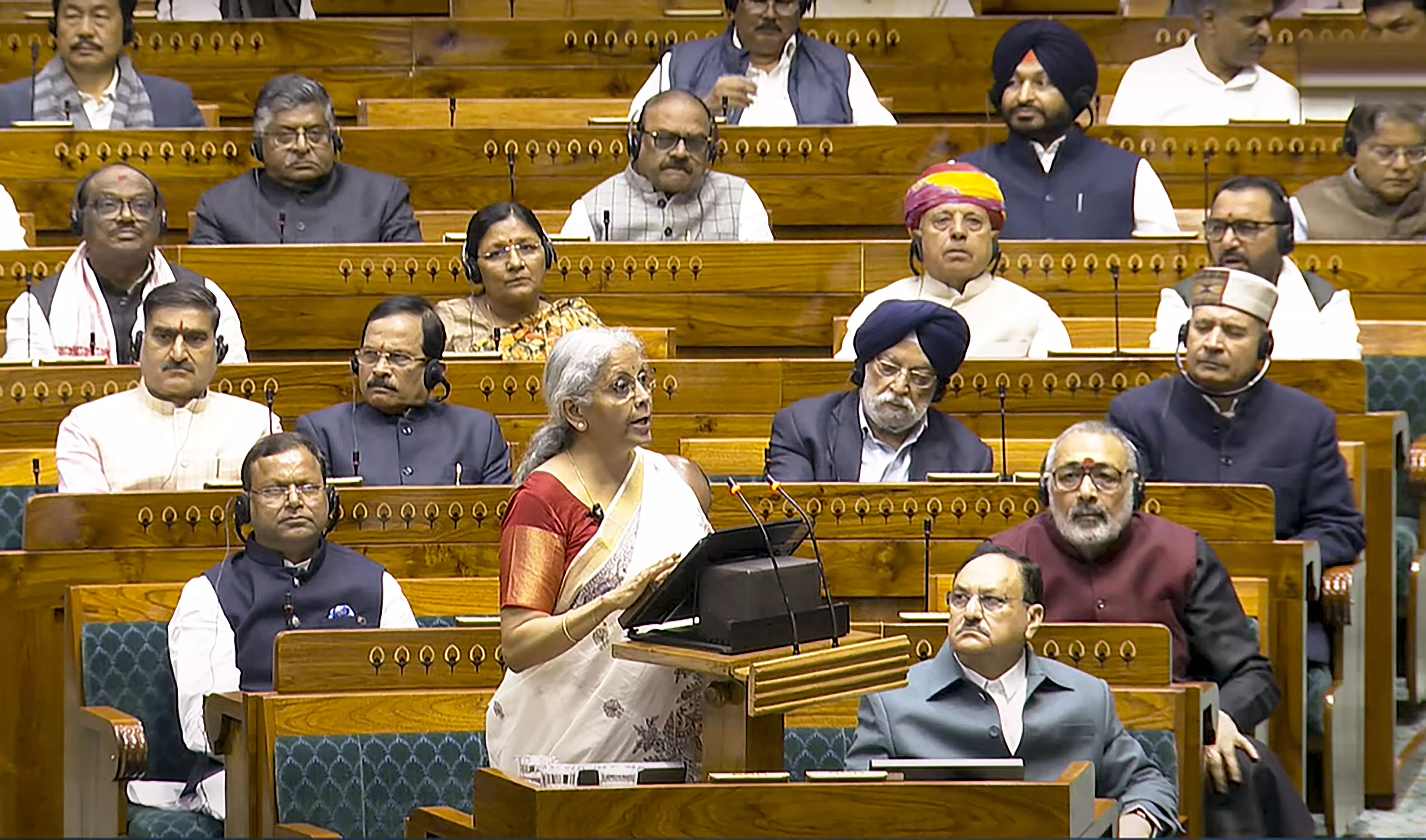

Presenting her eighth consecutive budget, FM Nirmala said the government's development track record of the past 10 years and structural reforms have drawn global attention.

Higher exemptions and rejigs have been effected under the new income tax regime.

"I am now happy to announce that there will be no income tax payable up to income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime," the finance minister said.

"The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment," Sitharaman said in her Budget speech.

As per the rejig, for people earning more than Rs 12 lakh per annum, there will be nil tax for income up to Rs 4 lakh, 5 per cent for income between Rs 4 and 8 lakh, 10 per cent for Rs 8-12 lakh, 15 per cent for Rs 12-16 lakh.

A 20 per cent income tax will be levied on income between Rs 16 and 20 lakh, 25 per cent on Rs 20-24 lakh and 30 per cent above Rs 24 lakh per annum.

A person with an income of Rs 25 lakh gets a benefit of Rs 1.10 lakh.

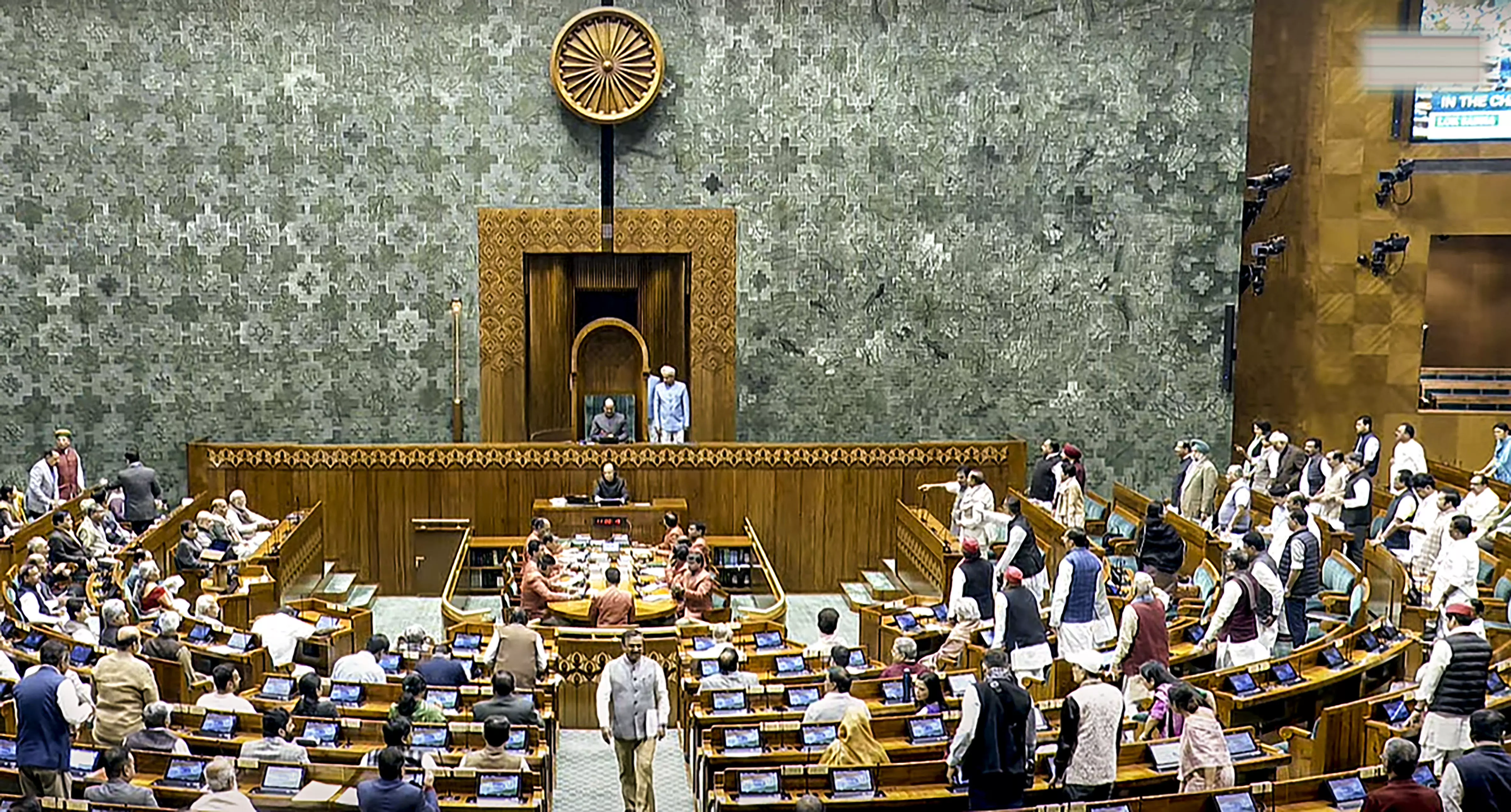

The government will also be introducing a new Income Tax (I-T) bill in Parliament next week.

Meanwhile, the government will increase the limit of TCS on remittances under RBI's liberalised remittance scheme from Rs 7 lakh to Rs 10 lakh.

Also, Sitharaman said that 35 additional goods for EV battery, 28 additional goods for mobile phone battery production will be included in the list of exempted capital goods.

Live Updates

- 1 Feb 2025 12:16 PM IST

In recognition of the citizens’ 23, contribution to nation building, we want to reduce the tax burden on the tax payers, particularly the middle class.

- 1 Feb 2025 12:10 PM IST

Investment friendliness index of states will be launched this year: Sitharaman.

- 1 Feb 2025 12:09 PM IST

She also said NaBFID (National Bank for Financing Infrastructure and Development) will set up partial credit enhancement facility for corporate bonds.

- 1 Feb 2025 12:09 PM IST

The finance minister said the government will set up a high-level committee for regulatory reforms on all non-financial sectors.

- 1 Feb 2025 12:08 PM IST

The fiscal deficit for FY25 has been pegged at 4.8 per cent of GDP and at 4.4 per cent for FY26, Finance Minister Nirmala Sitharaman said on Saturday. Presenting the Budget 2025-26, she said net market borrowings are estimated at Rs 11.54 lakh crore for next fiscal year.