IQ Option’s Guide To The Optimal Entry And Exit Times

Discover the prime trading sessions and entry/exit times for Forex and stock markets;

Just like people, markets have active and quiet times. It's best to trade when the market is busy because there are more volatility, participants, and opportunities. Here are the IQ Option’s suggestions on when it's most active and when it's best to enter and exit trades.

Trading Sessions

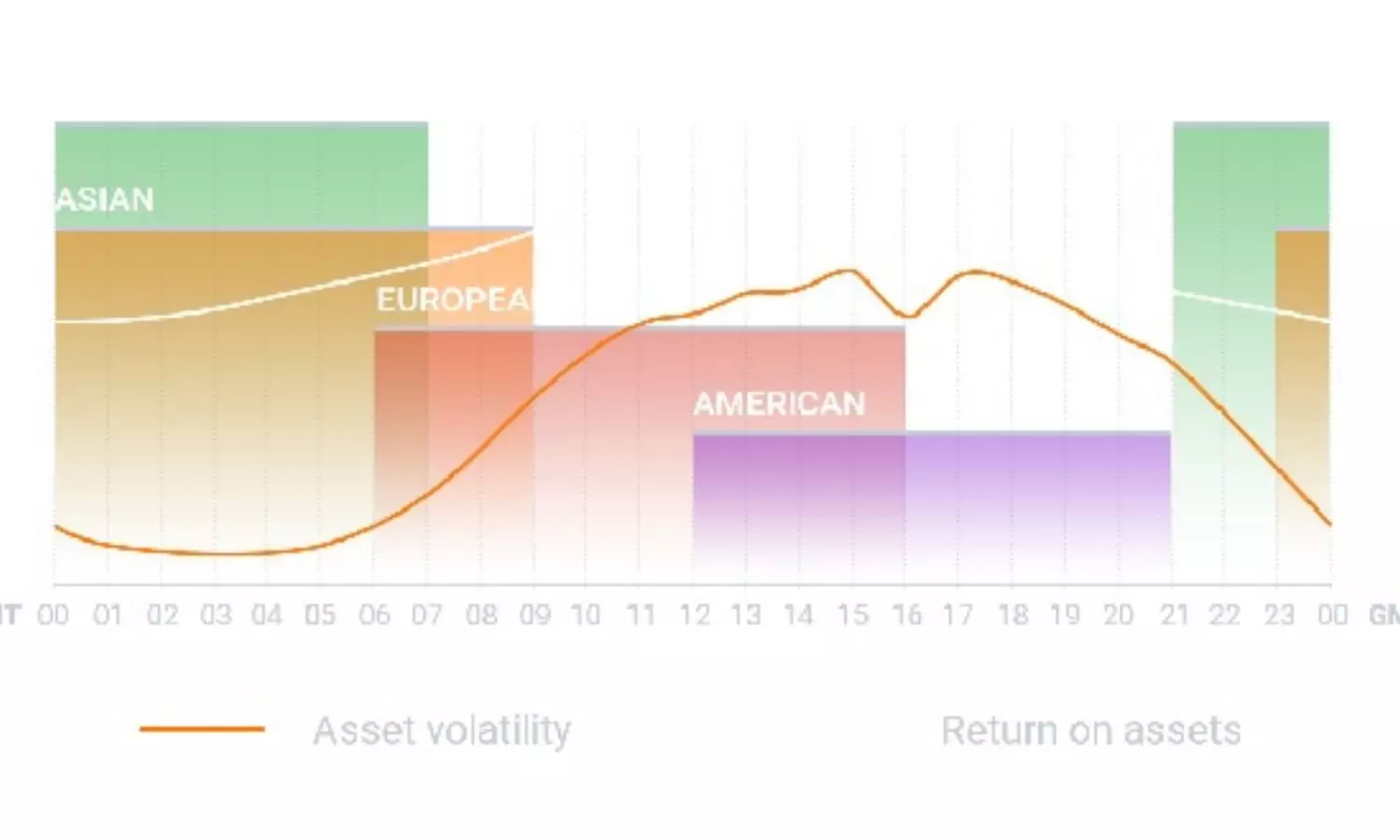

Financial markets operate 24/5, with each trading session overlapping to create potential opportunities. Traditionally, traders focus on three peak activity sessions: the European, Asian, and North American sessions, also known as the London, Tokyo, and New York sessions, respectively.

The Asian session

Running from 23:00 to 8:00 GMT, the Asian session encompasses countries like Japan, China, Australia, and New Zealand.

Assets to trade: all JPY, NZD, and AUD currency pairs; Asian companies’ stocks

Entry Time: from 23:00 GMT

Exit Time: 8:00 GMT

The European session

The European session overlaps with both the Asian and American sessions. Major financial hubs like London, Frankfurt, Paris, and Moscow contribute to the activity, with popular currency pairs including the GBP and EUR.

Assets to trade: EUR/USD, GBP/USD, European stocks

Entry Time: from 7:00 GMT

Exit Time: 16:00 GMT

The American session

The New York session involves not only the USA but also Brazil, Mexico, and Canada. The overlap with the European session adds to currency pair dynamics due to increased trading activity.

Assets to trade: USD/JPY, USD/CAD, US stocks

Entry Time: from 12:00 GMT

Exit Time: 20:00 GMT

Best times to trade Forex and stocks

● For Forex trading, market overlaps between the European and American sessions (13:00 to 17:00 GMT). However, higher activity also means heightened volatility, requiring smart risk management.

At IQ Option, traders can use Stop-Loss, Take-Profit, and Trailing Stop orders to protect their trades from the unexpected volatility outbursts.

● For stock trading, opening hours typically see higher volatility due to market news and events. Understanding the sources and reasons behind asset volatility (for example, important news, such as corporate releases]) is equally important.

Traders can utilize the calendars and newsfeed available on IQ Option to pinpoint the best time to trade stocks.

Conclusion

By recognizing the busiest trading sessions — Asian, European, and American — traders can capitalize on increased activity. With IQ Option's 24/7 accessibility on both web and mobile platforms, traders can stay connected to the markets at all times, while utilizing risk management and analytical tools available on the platform.