PNB scam: CBI to probe Nirav Modi's top official, seals Mumbai branch

New Delhi: The Central Bureau of Investigation (CBI), on Monday, summoned Nirav Modi's Chief Financial Officer to investigate a Rs 11,400 crore Punjab National Bank (PNB) fraud case to benefit the billionaire jeweller to stars in India and abroad.

Ravi Gupta, Nirav Modi’s Chief Financial Officer (CFO) has been called for interrogation in Mumbai.

Another top official of the billionaire jeweller’s Firestar International Company, Vipul Ambani, was already probed on Sunday along with other officials.

The CBI has also interrogated 11 officials of PNB with regard to the scam involving fake Letters of Undertaking (LoU) put out by ex-bank officials to help Nirav Modi, his uncle Mehul Choksi - who heads Gitanjali Jewels - and others get credit from banks outside the country.

Read: Will take 'appropriate supervisory action' in PNB fraud case: RBI

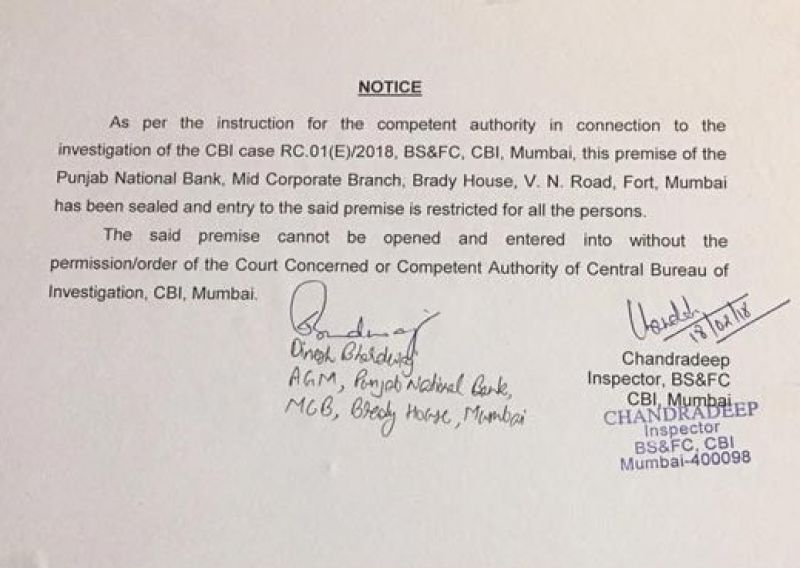

The probe agency is known to have sealed PNB's Brady House branch in Mumbai, where the scam occurred.

The CBI has written to other Indian banks urging them to report any similar case of fraud that involves false guarantees in the form of LoUs.

The investigating agency, on Saturday, arrested ex-PNB deputy manager Gokulnath Shetty, single window operator Manoj Kharat and Hemand Bhat, the group’s authorised signatory, over their role in issuing false guarantees at an enormous price to the taxpayer.

Also Read: CBI arrests PNB ex-official Gokulnath Shetty, key accused in bank fraud case

Gokulnath Shetty admitted to using his access to a Level-5 password – the key to SWIFT software interface used to grant LoUs. He reportedly shared the password with top officials of Nirav Modi’s company.

Read: Gitanjali Gems shares continue fall, plunge 10 pc on Monday

LoUs are guarantees from banks promising to pay back the original lender, if the borrower defaults to repay a loan.

The PNB fraud case surfaced in January when Nirav Modi’s companies and Mehul Choksi approached the Brady House branch in Mumbai for fresh LoUs to pay off suppliers. The bank on probing past transactions, found no record of authentic guarantees in books.