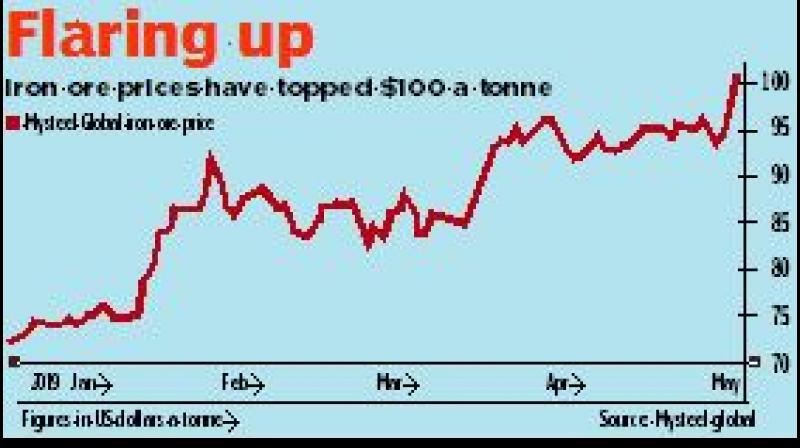

Iron ore price crosses $100 on supply issues

Iron ore rallied above $100 a tonne, surging to the highest since 2014, as investors bet that a global supply crunch will spur a scramble for cargoes just as China’s mills push out record volumes of steel.

Benchmark spot ore climbed 2.5 per cent to $100.35, according to Mysteel Global. Earlier, most-active futures in Singapore jumped as much as 3.8 per cent, while miners' shares powered ahead, with Fortescue Metals Group Ltd. hitting the highest since 2008.

Iron ore has staged a stunning rally in 2019 as supply disruptions in Brazil and Australia, the top shippers, spurred forecasts the seaborne market will swing to a deficit. At the same time, mainland mills have been producing record quantities of steel, underpinning expectations for strong import demand. That means, while other materials such as copper have been harmed by concerns the US-China trade war will hurt demand, iron ore has vaulted higher.

The genesis of the rally was a tragedy in Brazil in January, when a Vale SA dam burst, triggering a slew of mine curtailments as its operations came under intense scrutiny. This week, state prosecutors recommended Vale warn people that a structure at its Gongo Soco mine may be close to breaking point.

“Part of the reason for this rally has been the risk of another dam collapse for Vale that is unfolding before us now,” Hui Heng Tan, an analyst at Marex Spectron Group, said by email. “Such contagion risk would only cast more doubt as to whether the Brucutu mine, which is in the same region, will reopen.”

On Thursday, a senior Brazilian official said that nationwide production may shrink by 10 per cent this year, with the 2020 outlook still unclear. Sanford C. Bernstein & Co. estimates that the world's top miners including Vale will ship about 283 million tonne this quarter, 10 per cent lower year-on-year.

Miners have benefitted as prices surged. Australia's Fortescue has more than doubled its market value this year after raising dividends, while top US producer Cleveland-Cliffs Inc and Anglo American Plc's Kumba Iron Ore Ltd have jumped. On Friday, BHP Group and Rio Tinto Group climbed in Australia.

Key to the rally over the past three months has been declines in port holdings in China, which have sagged to lowest since 2017.