10th GST Council meet clears law for compensation to states

Mumbai: The GST Council on Saturday approved certain provisions of important legislations that will now help clear the decks for the model GST law to be tabled in Parliament, most probably in the ongoing Budget session.

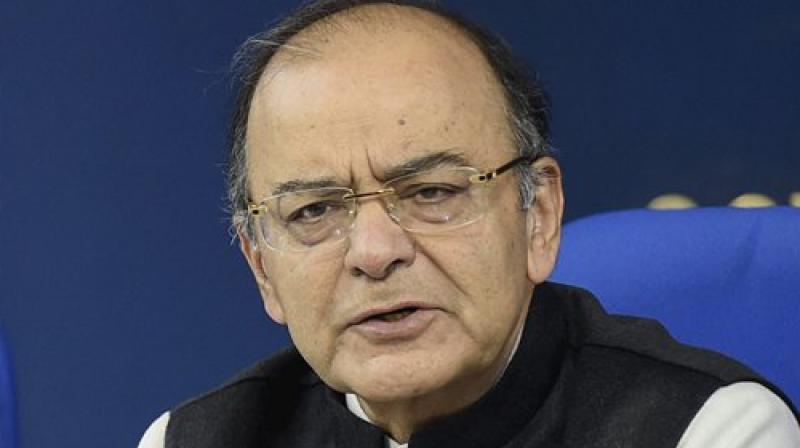

"It was essential that enabling laws for GST are passed in second half of Budget session to ensure its rollout from July 1," Finance Minister Arun Jaitley said. Legally vetted draft of GST Compensation Law approved by GST Council to be taken to Parliament in second half of Budget session next month, he added.

According to ET Now, the Council has approved the draft Compensation Bill which the government hoped soon it would be able to table it in Parliament. The compensation law defines the contours of revenue sharing between the Centre and the states and also explores ways to compensate them for loss of revenue.

The Council has given green signal to Central GST, Integrated GST, States GST and Compensation GST, with some issues remaining to be sorted out. Once fully cleared, barring a few technical hurdles, then draft model GST law will be set to see the light of the day.

"One major meeting of GST Council will be required to give approval to putting goods and services in different tax slabs. Council to approve C-GST, I-GST and S-GST laws at its next meeting on March 4-5," Jaitley said

Clearance to all the above drafts was important for taking the legislative process to the next level. Earlier, the draft GST law was not moving ahead as the Centre and the states were not changing their stands on various aspects.

Among key measures, the Council today gave its nod to anti-profiteering clause that wants to front-load low tax rate benefits to consumers, according to CNBC-TV18. It means it does not seek to overburden end consumers with an over-rated GST.

The all-powerful Council is meeting again on March 4 and 5 to further take up some issues that still need to be vetted and subsequently sorted out.