Jaypee Infratech lenders to meet on Thursday

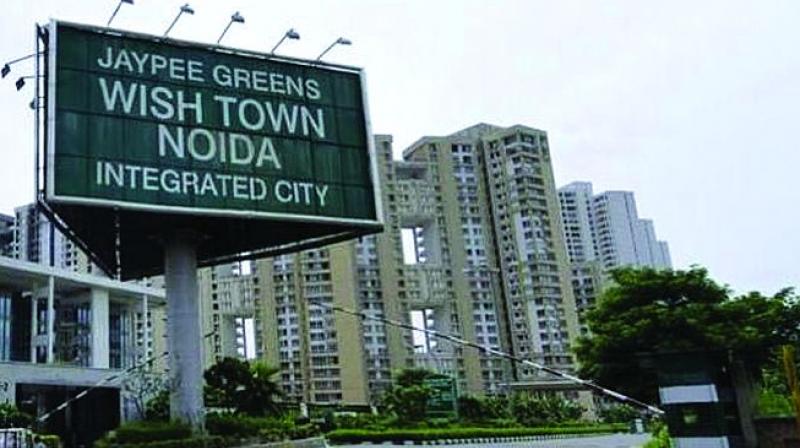

New Delhi: The fate of debt-laden Jaypee Infratech as well pending housing projects which have been stuck for a long will be decided by this week as lenders have shown reluctance to acquire up to 2,207 unsold flats worth Rs 1,756 crore as proposed by NBCC in its revised offer.

According to a source, a meeting of committee of creditors (CoC) has been called on May 30 to discuss state-owned NBCC’s bid to acquire the realty firm. Jaypee Infratech’s financial creditors are bankers and homebuyers. “As many as 13 banks and 23,000 homebuyers have voting rights in the committee,” the source said.

Earlier this month, creditors rejected a bid by Mumbai-based Suraksha Realty through a voting process. Later, the CoC decided to put on vote the NBCC’s offer even as bankers were opposed to this move, citing certain conditions in the resolution plan submitted by the public sector firm.

On a plea from the bankers, the National Company Law Appellate Tribunal (NCLAT) had on May 17 annulled voting by homebuyers and lenders on NBCC’s bid and allowed renegotiation on the offer by May 30. The voting process could start from May 31.

At present, bankers and NBCC are negotiating on the latter’s bid to acquire Jaypee Infratech. How-ever, sources had earlier said that NBCC was unlikely to dilute certain conditions, including exemption from future tax liability, mentioned in its bid but the public sector firm was open to negotiating on the offer related to unsold flats.

In its latest offer, NBCC has proposed infusion of Rs 200 crore equity capital, transfer of 950 acres of land worth Rs 5,000 crore as well as Yamuna Expressway to banks and completion of flats by July 2023 to settle a claim of Rs 23,723 crore.